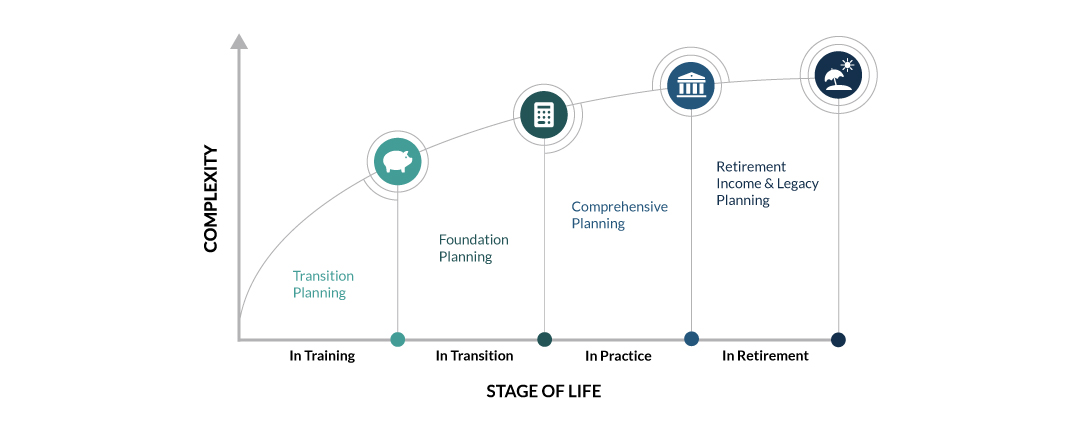

Transitioning from residency to attending life is exciting, but it can be financially overwhelming. Between student loan payments, new income, and big life decisions like where to live or work, it’s easy to feel unprepared. Understanding the financial life cycle of a physician can help you plan ahead and avoid costly missteps.

Below, we outline the key financial stages that physicians encounter and provide practical advice tailored to each phase of their careers.

You may not realize it, but you have already been making financial decisions. It is important to articulate your short-term and long-term goals, so you don’t look back in a few years and wish you had made a plan sooner. Practicing physicians go from making around $64,000 annually as a first-year resident to $200,000-$400,000 annually as an attending. Quite a big jump, right?

The truth is, more money doesn’t make financial planning any easier. The more money you are making, the more “big ticket” items you can buy, along with larger loan sizes lenders will offer you.

What you are rapidly discovering is the financial stages in the life of a physician, from medical school to retirement.

Residency is your first step toward financial independence. Although your income is still limited and your debt is high, this is the time to build smart habits.

Key Priorities:

While it might feel like you’re just surviving financially, this is the stage where your financial discipline matters most.

This stage brings more unknowns: additional training, relocating to a new city, job interviews, and negotiating contracts. Your income might increase modestly during fellowship, but major decisions lie ahead.

Key Priorities:

Consider long-term objectives while remaining focused on immediate goals, such as reducing debt and boosting savings.

You’ve made it to attending status. Your income has jumped significantly, and the financial decisions you make now will shape your future.

Key Priorities:

It’s also time to start building long-term wealth. Consider working with a financial planner to ensure your investment strategy aligns with your goals.

This stage often brings stability: a growing family, an established career, and increasing expenses. You may be buying a home, funding private school or college, and continuing to manage student loans.

Key Priorities:

As you progress in your career, you may also consider practice ownership, passive income, or charitable giving.

In your final working years, your focus should shift to preserving what you’ve built. You want confidence that you can retire comfortably, without surprises. Three factors that will affect your financial situation now include your income, living expenses, and savings. After working hard to take care of your patients and family, you have time to take care of yourself. Ask yourself if you want to travel to see the world, volunteer, be there for your grandchildren’s milestones, or a combination of those three? With a solid and steady retirement plan throughout your years of practicing, you will be able to retire knowing you are adequately prepared.

Key Priorities:

With a solid financial plan, retirement can be a fulfilling chapter where you focus on what matters most.

Many physicians make avoidable mistakes along the way. Here are a few to watch out for:

Avoiding these missteps can help you stay financially confident and avoid setbacks.

The sooner, the better; ideally during residency. Small, consistent contributions made early can make a difference.

Wherever you are in your financial life cycle, planning with purpose matters.

Schedule a free discovery call with one of our financial planners. They understand the physician journey and can help guide your next steps.

CRN202805-8690996

John Dameron has been a financial planner and partner with Spaugh Dameron Tenny since 2002. With the help of the SDT team, John created a lecture series called Physicians Financial Focus, authored a book entitled The Residents and Fellows Financial Survival Guide, and has coached hundreds of physicians from residency/fellowship into practice. His expertise has also been featured on KevinMD.

If you’re a high-income earner, such as a physician, executive, dentist, or business owner, it’s important to understand how Social Security fits ...

Read More →Best Budgeting Apps for Every Stage of Life At Spaugh Dameron Tenny, the first part of our pledge to clients is simple yet powerful: We Empower You. ...

Read More →When physicians accept a new role, especially with a hospital or healthcare group, they're often offered a signing bonus. What’s less obvious is that ...

Read More →