Physicians and dentists work hard throughout their lives to take care of their families and experience a stress-free retirement. Estate planning is an important part of retirement planning, especially for those who want to leave a lasting legacy for their loved ones. This type of planning may not be as fun or glamorous as planning vacations or buying a dream car, but it is crucial to decide who will inherit your assets after you are gone.

Estate planning is a broad term that covers a variety of methods for determining what happens after your death, including the disposition of assets and appointing a guardian for your children.

To put it simply, your estate plan is arranging the management and ownership of everything you own during your life and after death. Without an estate plan, you risk leaving those decisions up to a judge and the laws of your state.

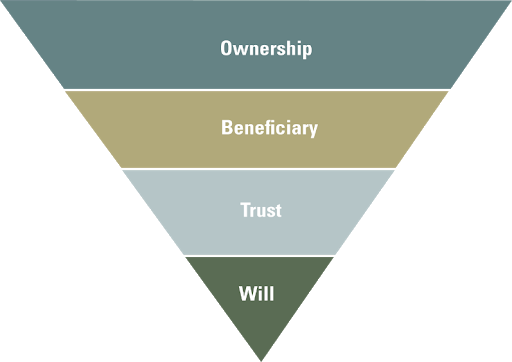

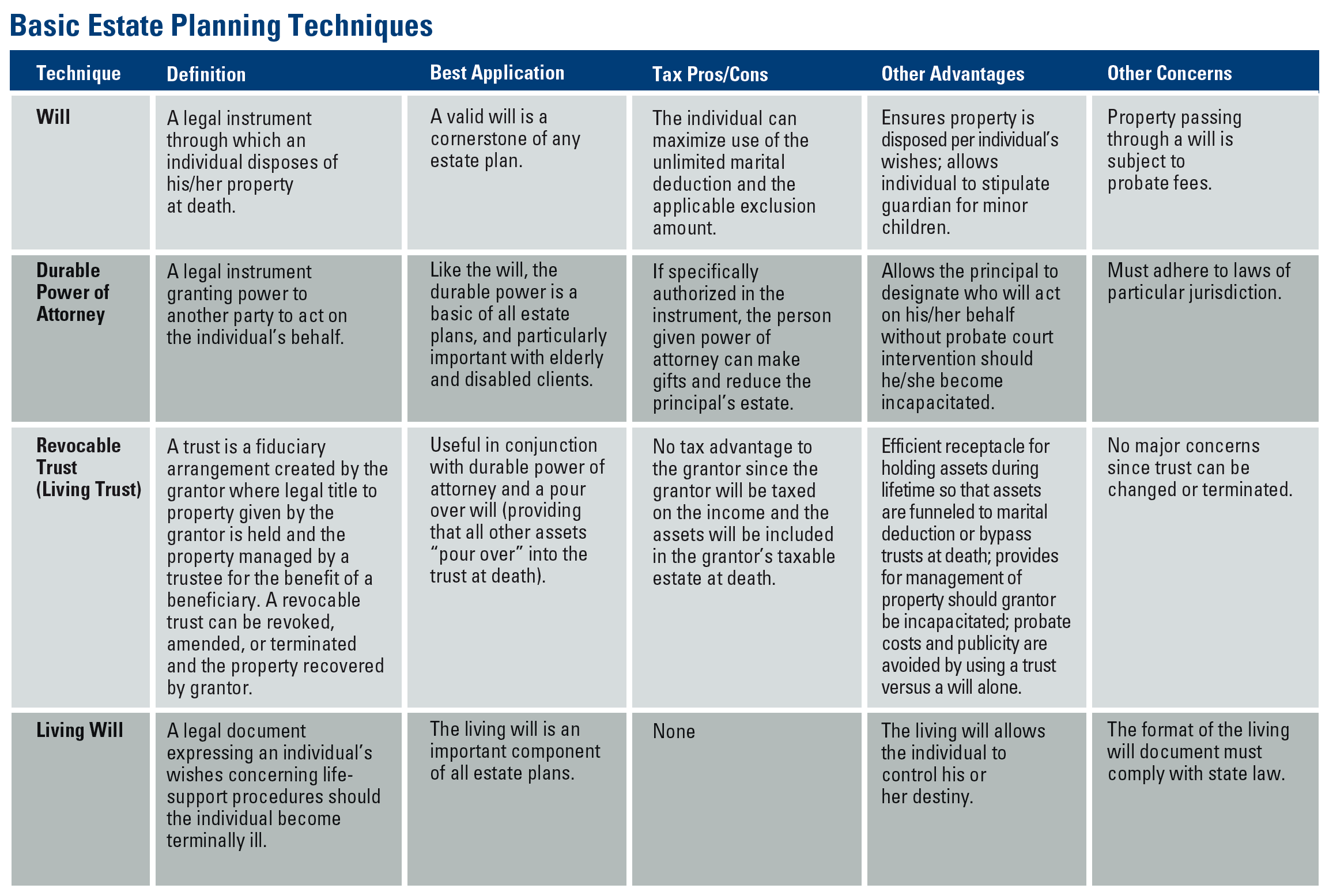

An essential piece of an estate plan and probably the most common term is a will. Surprisingly, a will is the least effective tool for transferring assets at death.

In fact, the will is just the “catch-all of last resort” because the first rule governing the transfer of assets is ownership.

With that being said, a will is a good place to start to ensure you have a plan so that you can streamline the process for your loved ones.

The estate planning basics are composed of many terms and documents you need to understand. Not having estate documents is a colossal error that can be so easily remedied. A way to remedy this is to hire an estate attorney. By hiring an estate attorney, you know that you will have a sound plan that is perfected by a professional.

Here are some of the basic documents your estate attorney needs to get started:

One of the biggest estate planning mistakes is to die without a will.

Dying without a will means you are “intestate,” leaving it up to the courts and state law to determine guardianship for your minor children and how your assets are distributed. This may mean the spouse who survives gets everything, or maybe must split the assets with your children.

What if you are legally separated but not divorced? Children entitled to a share under intestacy will receive it outright upon reaching the age of majority (usually 18) Is this what you would have wanted? Putting a will together can help you decide these things ahead of time and prevent disputes amongst family members left behind.

In addition to naming a guardian and providing instructions for your children’s inheritances, a will allows you to name an executor for your estate. An executor, usually a trusted friend, family member, or financial professional, is in charge of making sure the estate is distributed correctly, paying debts, and paying taxes.

Now that you are familiar with these basic estate planning terms, the main component of estate planning is protecting your beneficiaries. As mentioned earlier, there are three items that trump a will when it comes to the order of transfer.

Ownership

OwnershipThe first rule governing the transfer of assets is ownership. A house that is owned jointly with a spouse will transfer to them at the first spouse’s death.

Some assets like retirement accounts or life insurance don’t have a joint owner but can have a beneficiary. In this case, the beneficiary will supersede the directions of the will.

Say a physician started in practice 5 years ago and named their parents as beneficiaries on their 401(k). Now, although the physician is married, if they die, the parents will receive the 401(k) regardless of the current spouse’s needs.

This leads to an important question to ask yourself: When was the last time you reviewed and updated your beneficiary designations?

Whether it’s a vacation home or stock portfolio, designating heirs for your assets will give you control over who receives them. Without an estate plan, the courts will often decide who gets your assets. This can be a grueling process that can take years and rack up costly attorney or court fees associated with probate proceedings for your loved ones.

A trust is another effective way of holding or transferring assets that gives you control over who and how money is distributed.

Finally, for anything that does not have a joint owner or beneficiary, or is not in trust, the will governs the distribution.

A living will, or advance medical directive, is another element of estate planning. You may be familiar with an advanced medical directive as a physician or dentist in the field.

Other steps in preparing an estate plan include assigning power of attorney to someone who can act in your place should you become incapacitated. The person with designated power of attorney can pay your bills, manage investments, and make other decisions while you are still alive.

It's no secret that estate planning can be quite overwhelming. A good financial planner can make the process easier for you as they are in a position where they understand your financial picture.

Because they are an expert in your finances, a financial planner helps oversee your beneficiary designations, retirement accounts, investments, trust documents, and other personal property. They can help you compile the necessary information as you prepare to meet with your estate planning attorney.

At Spaugh Dameron Tenny, we are always happy to help you understand your financial documents. We can also help you find a trustworthy estate planning attorney that will help you create a secure estate plan that includes all your assets.

So, what are you waiting for? Don’t let the state make your decisions for you. We offer a complimentary discovery call to any doctor who has retirement or estate planning questions.

CRN202605-4373163

Jordan Bilodeau, CFP®, CEPA, is the Director of Planning & Strategy at Spaugh Dameron Tenny, where he leads firmwide planning initiatives and helps clients navigate complex financial decisions. With experience in portfolio design, tax strategies, and business succession planning, Jordan works with executives, physicians, dentists, and successful retirees to coordinate every aspect of their financial lives. He holds both the CERTIFIED FINANCIAL PLANNER® and Certified Exit Planning Advisor designations and has a Master’s degree in Wealth and Trust Management, providing tailored guidance for clients.

Inheriting wealth can evoke emotion, responsibility, and logistical challenges in ways few other life events do. Families often expect the financial ...

Read More →A Roth IRA is a tax-advantaged individual retirement account that allows qualified withdrawals to be made tax-free. Unlike a Traditional IRA, Roth ...

Read More →At Spaugh Dameron Tenny, part of our role is helping clients start each year grounded in facts, not headlines, assumptions, or half-answers. When ...

Read More →