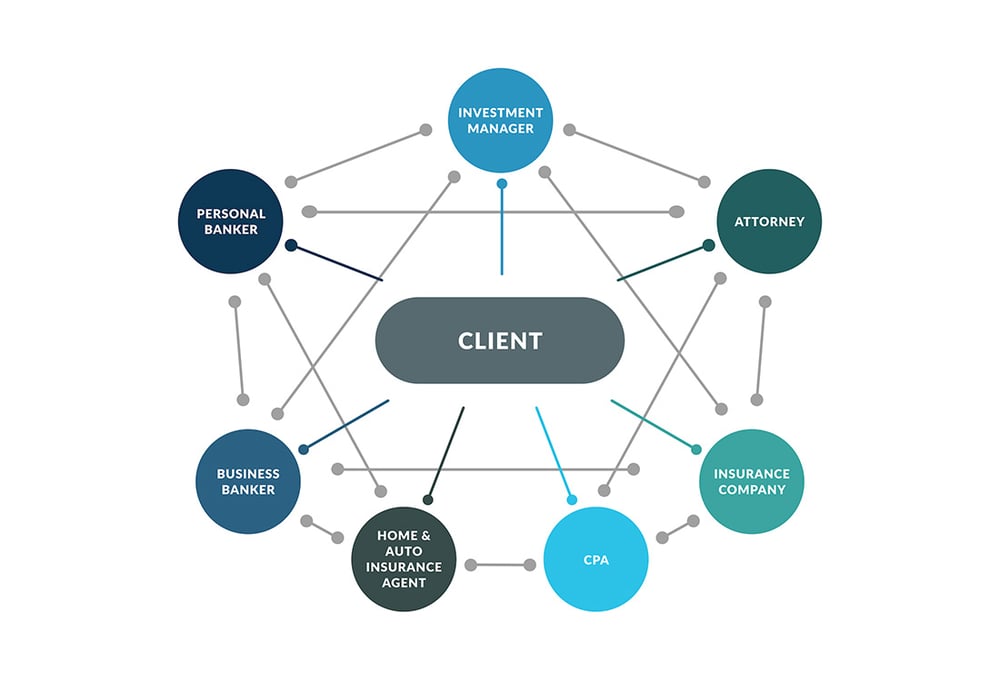

Without a single point of contact, you may experience wasted time, costly mistakes, and missed opportunities, leading to stress and uncertainty around your financial future.

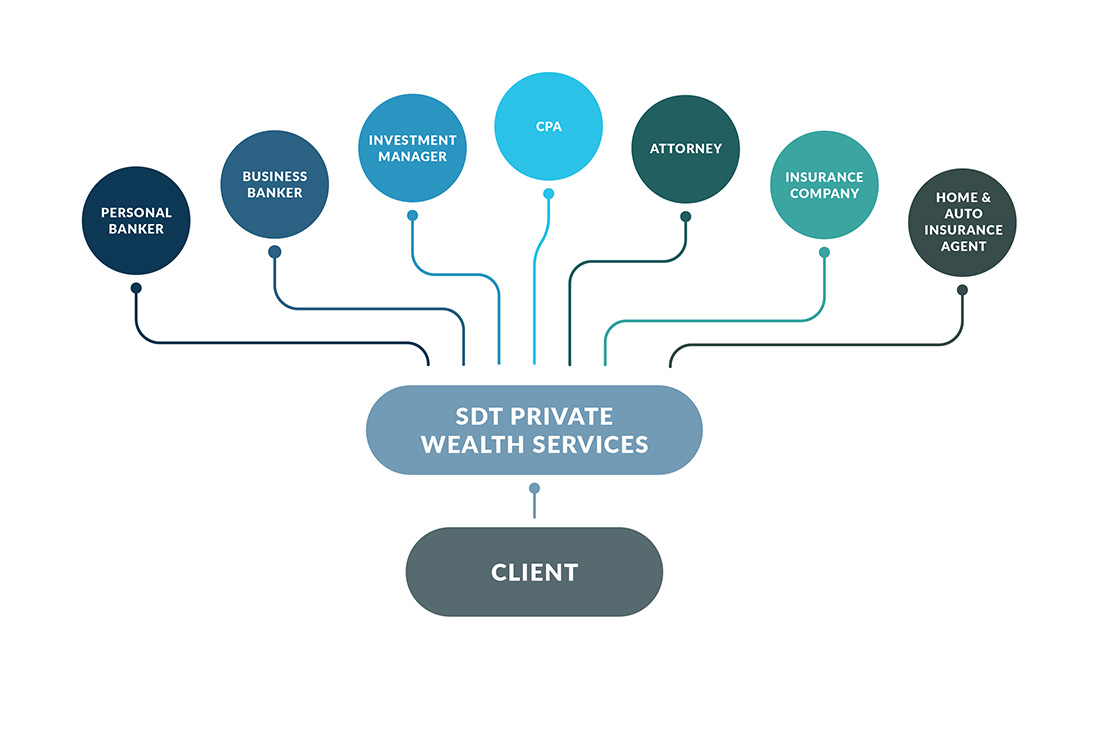

As a Private Wealth Services client, you can expect streamlined coordination between all your financial professionals. This personalized management can save you time by eliminating confusing and unnecessary conversations.

Our ultimate goal is helping you grow and protect your wealth for generations to come.

Our approach includes diversifying your portfolio, mitigating risk, simplifying the process, and much more. Learn more about our approach by reading our Investment Philosophy.