We make thousands of choices each day, from what to eat for lunch to how we reply to a text. Among these are financial decisions that quietly shape our future. Should you make coffee at home or buy the $6 latte? It may seem minor, but these small choices add up over time. Each one fits into one of the 6 Money Decisions®—a framework that helps you understand where your money goes and how each decision impacts the next.

The 6 Money Decisions® cover how you earn, spend, save and invest, borrow, give, and protect your money.

Together, they form the foundation of a comprehensive financial plan that aligns your daily choices with your long-term goals.

Watch the video below for a breakdown of the 6 Money Decisions®, or keep reading.

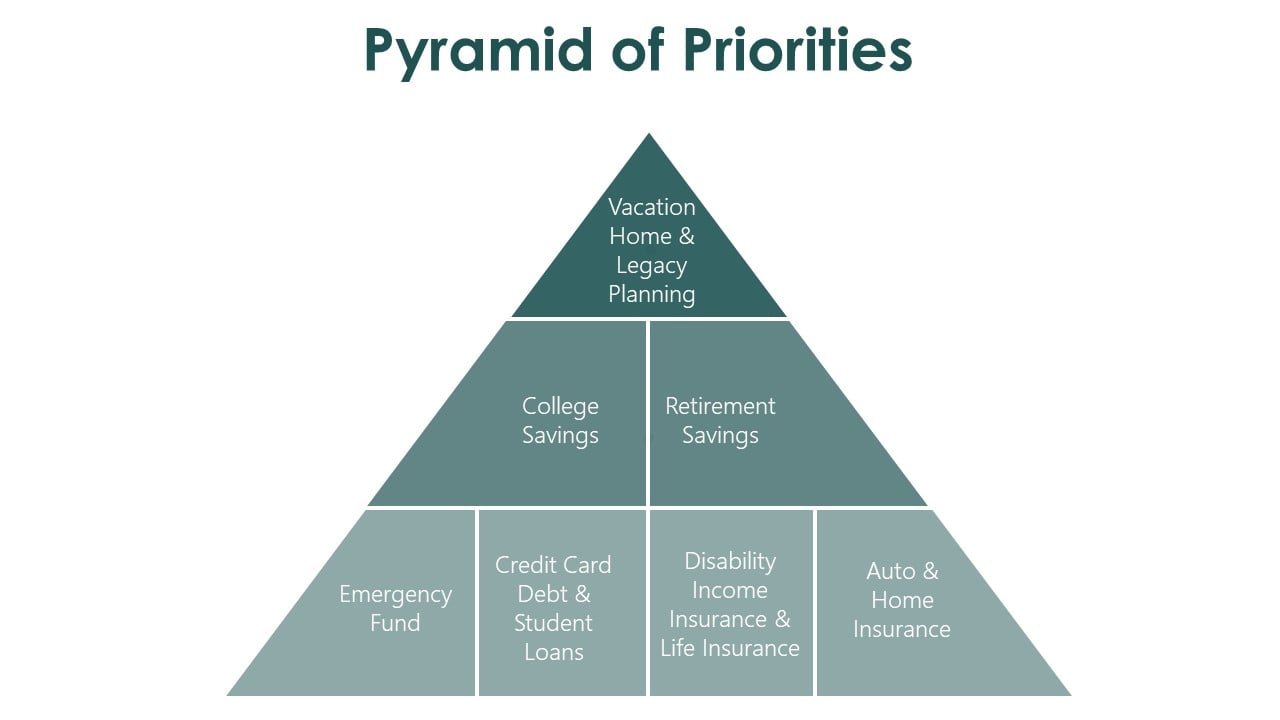

Before making strategic financial moves, it’s essential to build a solid foundation. The first four priorities in your financial pyramid are:

These core steps provide the stability needed to pursue long-term growth opportunities.

One of the most practical ways that we define financial planning is a disciplined process of making smart decisions about your money to align your behavior with your goals. Let’s break down the 6 Money Decisions®.

This might sound simple or obvious, but as your career progresses, you face more decisions about how your income is generated. You don’t earn money solely through your salary. Your income can include your salary, business ownership, bonuses, real estate, or rental properties. And don’t forget about side gigs. As your career or business develops, so do the choices you make about how you earn and structure your compensation.

Your spending choices reflect your priorities, whether spending in the near or long term. Track both fixed and variable expenses to understand where your money goes. There are several methods of tracking those expenses, including a budget or cash flow worksheet.

Questions to consider: What’s worth spending on, and what’s not?

This decision category applies to general saving or investing. Saving supports your goals, covering emergency funds to retirement accounts like 401(k)s or Roth IRAs. These saving and investing options are essential for long-term success. The right combination depends on your objectives, cash flow, and tax considerations.

Borrowing decisions include mortgages, practice or business loans, or refinancing student loans. You should know whether to put down cash, how much to borrow, and how rapidly to pay off the debt.

The key question: Is this debt helping me reach my goals faster, or holding me back?

Giving happens both voluntarily (to family, charities, or your community) and involuntarily (through taxes). Understanding how to structure your giving can support your values and reduce tax strain.

Protection ensures your progress isn’t undone by unexpected events in case of an accident, sickness, death, or lawsuit. Insurance, legal structures, and estate plans help safeguard your income, assets, and loved ones.

Financial planning isn't just about isolated actions like opening an IRA or buying insurance. It’s about coordinating all six decisions so they work together. When one area is overlooked, it can ripple through the rest of your plan.

As your wealth and responsibilities grow, so does the complexity. A professional advisor can help you connect these pieces, allowing you to focus on what matters most.

The 6 Money Decisions® describe the main financial choices everyone makes – how we earn, spend, save, borrow, give, and protect our money. Each decision affects the others, and together they form the foundation of a comprehensive financial plan.

Understanding these six areas helps you connect your everyday financial behavior to your long-term goals. When all six work together, you can make confident choices, stay organized, and develop greater financial stability over time.

Each decision is a part of your overall plan. For instance, protecting your income with insurance affects how much you can save or invest, while managing debt wisely can free up money to give or build wealth. A comprehensive plan coordinates all six areas to help you reach your goals.

Focusing on one money decision in isolation, like investing before building an emergency fund, can leave you financially vulnerable. That’s why it’s essential to view your plan holistically and ensure all six categories are balanced.

A financial advisor can help you understand how your decisions connect, identify possible gaps, and focus on what’s most important right now. At Spaugh Dameron Tenny, we help clients in coordinating these six areas so their financial life functions smoothly, effectively, and with confidence.

Ideally, as soon as you begin earning an income. But it’s never too late to begin. Whether you’re building wealth, planning for retirement, or managing complex compensation, understanding the 6 Money Decisions® can help you make smarter, more aligned choices.

If you find yourself wondering whether your money decisions are aligned with your goals, you’re not alone. Many of our clients say they wish they’d started their plan sooner.

A complimentary discovery call with one of our financial advisors at Spaugh Dameron Tenny can help you see your full picture and decide what comes next.

Schedule a Complimentary Discovery Call →

CRN202810-9683515

Shane Tenny, CFP®, is the Managing Partner of Spaugh Dameron Tenny and a nationally recognized financial advisor. Since 2000, he has combined extensive financial knowledge with a passion for behavioral finance—helping clients make informed decisions based on both data and mindset. Shane often contributes to industry publications, appears as a guest on podcasts, and has been a leader in the financial planning field for years. He is known for making complex topics clear and practical for busy, high-income professionals seeking personalized advice they can trust.

Finance has a reputation for being complicated, and not without reason. Like many specialized fields, it comes with its own language, acronyms, and ...

Read More →If I had a dollar for every time a new client made one of the comments below, I’d have … well, a lot more dollars.

Read More →At Spaugh Dameron Tenny, part of our role is helping clients start each year grounded in facts, not headlines, assumptions, or half-answers. When ...

Read More →