.png?width=678&name=Copy%20of%20Transition%20Planning%20for%20Doctors%20(1).png)

Saving sounds like a great thing to do to make yourself or your parents proud, but it is often easier said than done.

You may have dreams to travel or buy a house. We aim to make those dreams a reality until… life happens.

Your friends may all decide to get married in the same year, and we all know weddings aren’t cheap. (This is especially true if you are part of the wedding party.) Travel costs, attire, and wedding gifts are undeniably expensive, so how do you become financially prepared for these life moments? The answer is in saving. Saving is a crucial financial habit to make. In order to stay sane and feel secure during the unexpected things that pop-up in life, an emergency fund is the best place to start. How do you build an emergency fund and make the most of it? Let’s dive into 4 practical ways to save for emergencies and future expenses.

Goals and wishes are two totally different things.

A wish is “I hope I have enough money in my account to last while I transition from training to practice in 24 months.”

A goal is action-oriented with a timeline. “In 24 months, I will have $6,000 in a savings account to help me manage the transition from training into practice. In order to accomplish this goal, I will set aside $250 a month.”

Just as you wouldn’t tell a patient they should “try to remember to lose weight before surgery in six weeks,” you don’t want to leave your financial future up to inconsistent whims. Instead, you would tell your patient, “You must lose 16 pounds in 6 weeks, and here’s the diet regimen you must follow to accomplish that goal.” The longer you put off starting on your goal, the larger the changes to your budget will need to be. To avoid the pain of large life-altering changes, start planning as early as possible.

Your emergency fund is easy to calculate, and we suggest saving 3-6 months of expenses. Here are the eight monthly expenses you should include:

Once you add these eight monthly expenses, multiply them by six to get the total amount you need to save for an adequate emergency fund.

Once you reach the amount you set for your emergency fund, you may believe that your monthly savings draft is now free to spend. The problem with this mindset is that your monthly expenses can begin to add up if you don’t watch your “fund worthy subscription services” and other deemed necessities.

For example, your FabFitFun box or Bark Box may be one of those nonessential items on your budget. If getting this subscription box is truly important to you, planning for that added expense will help you in the long run.

This is where two different savings accounts would add value to your money life: an emergency fund account and an Other Than Monthly (OTM) account. If you don’t have enough cash flow to save in both, you should put more money in your emergency fund first before saving for non-essential items. Once your emergency fund is adequate, you can continue your habit of saving for those other things like upcoming weddings or your next vacation.

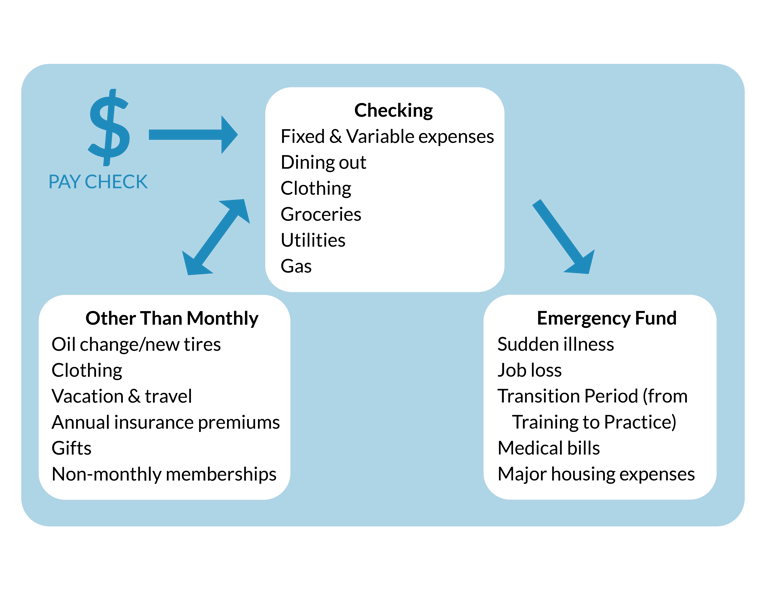

The image below breaks down what your different accounts can look like.

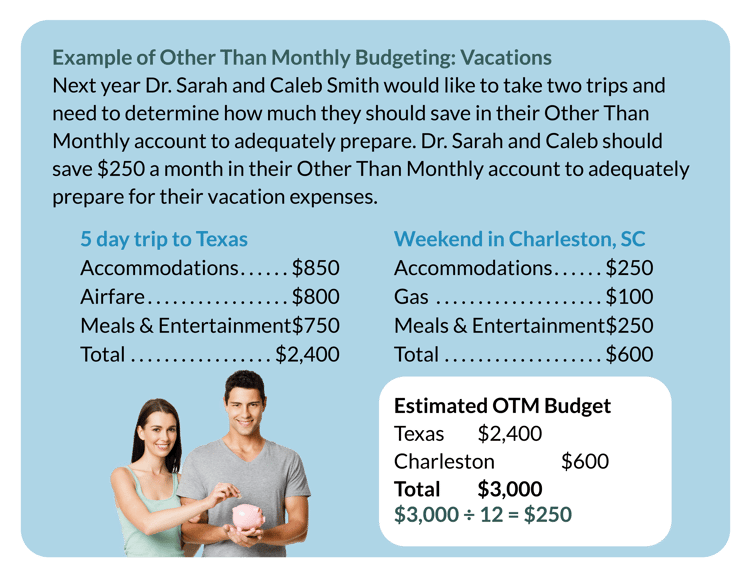

Your Other Than Monthly (OTM) account will be outside your checking and emergency accounts. OTM expenses may include vacations, annual or semi-annual insurance premiums, gifts, and clothing. The easiest way to calculate your Other Than Monthly expenses is to take your annual amount spent on OTM expenses (haircuts, car repairs, gifts, etc.) and divide the number by 12. Put that number in your budget and save for those less frequent occurrences on a monthly basis. Another way to simplify saving funds in your Emergency Fund and OTM account is to set up automatic bank drafts. You should have at least three accounts: checking, OTM, and an Emergency Fund. Money in your OTM account may be taken out to pay OTM expenses. Money in your Emergency Fund needs to stay in unless there’s an emergency.

You may have heard of the concept of the debt snowball. This is a very similar idea, but instead of paying off debt, we implement this strategy with our clients to capitalize on the opportunities to save money.

Let us give you an example of the savings snowball and action:

Imagine you have a car payment of $500 a month. The good news is that you will finally pay it off this month. How exciting! Unfortunately, this accomplishment of paying off your car only positively impacts your long-term financial future if you are able to repurpose that $500 a month toward your savings. The key here is to have automatic monthly savings set up. Similar to automatic drafts for your bills, your monthly saving “payment” should also be automatic. To capture the money you were previously allocating towards your car payment, you should increase your automatic monthly savings by $500. Otherwise, this $500 a month gets “washed down the spending stream”, as we like to say. Not only will you not save this money, but it can also lead to lifestyle creep. The next time you need to finance a car, it will be more difficult to find that extra $500 a month to put towards the payment because you will have become accustomed to the new lifestyle.

Another example of when the savings snowball can be implemented is when you receive a raise at work. Time to increase the monthly savings goal. Saving takes discipline, and it's easier to build that discipline if you have automatic savings mechanisms and if you're able to capitalize on opportunities to increase your savings amount. Try this out the next time you have a chance.

As mentioned above, designated cash reserves that are strictly used to cover things like an unexpected medical bill, replacing an air conditioning unit, or other big-ticket expenses are financial building blocks. The money in your emergency fund is not meant to be dipped into each month for ordinary expenses. While it is not advisable to have too much cash sitting idle, not working for you, it is infinitely better to have cash reserves than not have enough liquidity. This can cause you to have to pull from your investment accounts or use a credit card if you have a large unexpected expense.

There are a few characteristics that are very important when it comes to a good emergency fund. The first and foremost is being fully liquid. The second is that the money is easy to access, meaning the money can be transferred without penalty or restriction. Sometimes this results in people having their emergency fund as their primary bank sitting in a very low-interest savings account. While this is not a bad option, and your emergency fund is not meant for long-term growth, with a rise in online banking, there are options to get more interest out of your cash reserves. High yield savings accounts at online banks such as Ally and Discover Bank among others can typically yield much higher amounts than brick and mortar banks like Wells Fargo or Bank Of America.

Having emergency cash reserves with the sole purpose of covering unexpected expenses is the foundation of a solid financial plan. While you won't see instant riches, the takeaway from this segment is that there are options to squeeze a little bit more interest out of that bucket than by keeping it in a traditional checking or savings account.

The earlier you start saving, the better. Whether the wedding season is slowly starting to approach or you are trying to plan for a future practice transition, saving now will help you be financially prepared for the long-term. Having an account for emergencies and OTM expenses is crucial to walk the path of financial success. Without using these methods of saving, you may become short on money or have to skip out on some of the things you want to do in life.

Need more insight on how to create an action plan for saving? Download the Financial Survival Guide to learn how you can easily make a budget, manage debt, and face your finances head-on.

CRN202202-260718

The team at Spaugh Dameron Tenny works to present timely educational content that benefits doctors and their unique financial situations.

Whether you're launching your career, navigating a major life change, or preparing for retirement, it's never too early or too late to benefit from ...

Read More →This year, April 15th is the deadline to file your 2024 tax return, and it is quickly approaching. Whether you work with a CPA or another trusted tax ...

Read More →For those with significant financial success, a bonus represents more than just extra income. It’s a chance to create meaningful progress toward your ...

Read More →