September is Life Insurance Awareness Month (LIAM). How will you protect your biggest asset — you — if you pass away unexpectedly?

Life insurance is one of the most effective ways to prepare for your family’s continued support after your death. Most physicians and dentists in training should think through three important questions when considering life insurance:

To address the first question: You technically don’t need it.

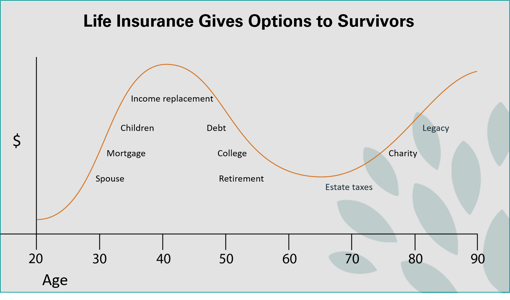

People die every day with no life insurance in place. And somehow the earth keeps on spinning on its axis, and the sun keeps rising in the east. Families go on. But what life insurance does is give options to survivors.

Sure, you don’t need it. In the event of your death, your spouse can move back in with their parents, downsize the house, or go back to work themselves.

Life insurance, however, gives your spouse the option of staying in the same house, being able to continue to live independently, and not having to look for "help wanted" signs.

The question you should consider is not how much you need — but what choices do you want your family to have? This answer is different for everyone.

There are two common ways to determine the amount of life insurance coverage you may want:

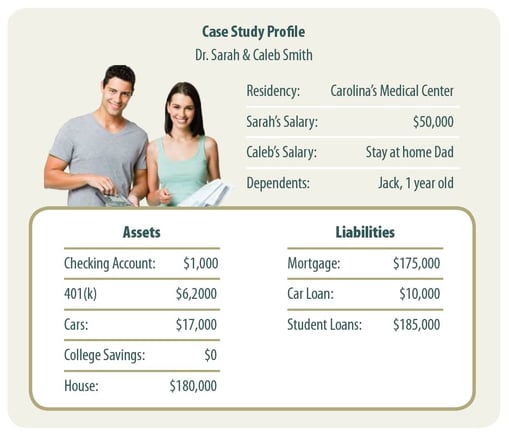

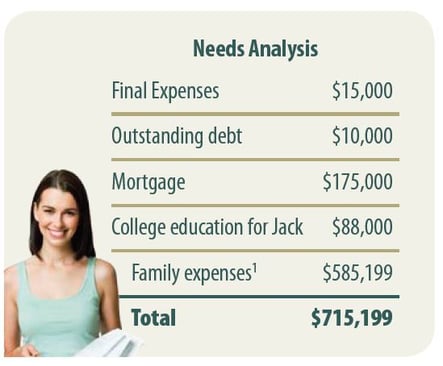

For this example, we will do a needs analysis on Dr. Sarah.

So, Dr. Sarah needs about $716,000 of coverage if she wants her family to be taken care of in the event of her death. She now needs to determine which type of insurance best fits her needs: term or whole life.

While in training, most physicians and dentists should have some type of term insurance. You can get a lot of coverage for a low premium while you are young and in good health. Some policies allow you to change your term policy to whole life without going through medical underwriting.

There are two basic categories of life insurance options: term life insurance and whole life insurance.

While term life insurance costs are often the most affordable, it's designed to provide coverage for only a specific period of time, such as a 10-year or 20-year term. In some cases, life insurance companies offer coverage for 30 years.

Like renting a house or apartment, term life insurance is similar to signing a lease with the landlord. Term insurance is flexible for physicians in training or new to practice who have tight cash flow.

Permanent insurance policies generally have higher premiums than term life policies.

All the premiums you pay go into the equity portion, which is available to you not just when you die. This means you could eventually borrow from your policy for many different reasons, including to:

This is a great option for emergencies, but it's important to understand the consequences of borrowing.

Within the cash-value life insurance label, there are specific product types including:

Sometimes people refer to cash-value life insurance as whole life, but this is just one type under the permanent life insurance umbrella. Understanding the difference between these types of life insurance is very useful.

Purchasing life insurance as a doctor or dentist in training is an important financial decision, and it requires careful consideration. Here are the steps to take when buying life insurance:

Determine the purpose of the life insurance policy. Is it to provide financial security for your family in case of your untimely death? Fund your children's education? Then, decide between term life insurance and whole life insurance.

Calculate your financial obligations, including outstanding loans, mortgages, education expenses, and your family's living expenses. Choose a benefit amount that adequately meets your financial goals and responsibilities.

Consider adding an optional waiver of premium rider at an additional cost. Some riders can enhance your policy with features like disability income, critical illness coverage, or student loan forgiveness in the event of death.

Prepare for a medical exam and underwriting process. As a doctor, you'll likely undergo a thorough health evaluation. Ensure you provide accurate medical history and lifestyle information.

Compare the premiums, policy terms, and conditions of different policies. Consider factors like renewal options, conversion privileges, and any exclusions. Consider working with an independent insurance agent who can provide you with a variety of options from different insurers.

Of course, read the policy documents carefully before signing. Ensure you understand the amount of coverage, premiums, and any limitations or exclusions.

Designate beneficiaries for your life insurance policy. You can name individuals, trusts, or organizations as beneficiaries. Review and update your designations as needed.

Periodically reassess your insurance needs and make adjustments to your policy if your circumstances change. This may include getting married, having children, or experiencing changes in your financial situation.

If you are single and have no dependents, life insurance may not seem important to you. But a few things to consider before writing it off completely are:

The short answer is most likely yes.

Oftentimes, if the non-working spouse dies, the surviving spouse is rarely able to continue working full-time, especially if there are children involved.

While working part-time, caring for children, and juggling other responsibilities that used to fall on the non-working spouse, the surviving spouse is left with a diminished income and increased responsibilities.

Life insurance is one piece of the puzzle when it comes to your comprehensive financial plan. There are four crucial pieces that are prudent to have in a solid financial foundation. Asset protection like disability insurance, home, auto, and life insurance is one of those four pieces.

In our Financial Survival Guide, find out what a sound financial foundation is comprised of. Plus, get actionable steps to implement the fundamentals of financial planning.

CRN202609-5011506

John Dameron, RICP®, CLTC, is a partner at Spaugh Dameron Tenny and a trusted financial advisor to executives, physicians, healthcare professionals, and retirees nationwide. With over 25 years of experience, John combines technical expertise with a coaching mindset to help clients reduce financial stress, clarify their goals, and implement practical, values-based strategies for lasting impact.

John is the author of The Residents and Fellows Financial Survival Guide and a popular speaker at medical centers and teaching hospitals across the country. Known for his patient, methodical approach, he equips clients to make confident, informed decisions, helping them to align their finances with their purpose and achieve long-term success.

Your greatest financial asset isn’t your home or even your portfolio. It’s your ability to earn an income. Years of training and the value of your ...

Read More →Too often, people make life insurance decisions under pressure, driven by fear or confusion, when they should base them on careful analysis. In this ...

Read More →Life changes fast – marriage, divorce, a new child, retirement, or a career transition. But one thing that shouldn’t fall through the cracks is your ...

Read More →