One of the challenges of being in a high-earning profession — whether in healthcare, business leadership, or another demanding field — is making smart, strategic financial decisions.

You might feel more pressure than ever in today’s economic environment, with inflation, high interest rates, and market uncertainty all vying for your attention. But even in uncertain times, there are steps you can take to improve your financial situation and prepare for the future.

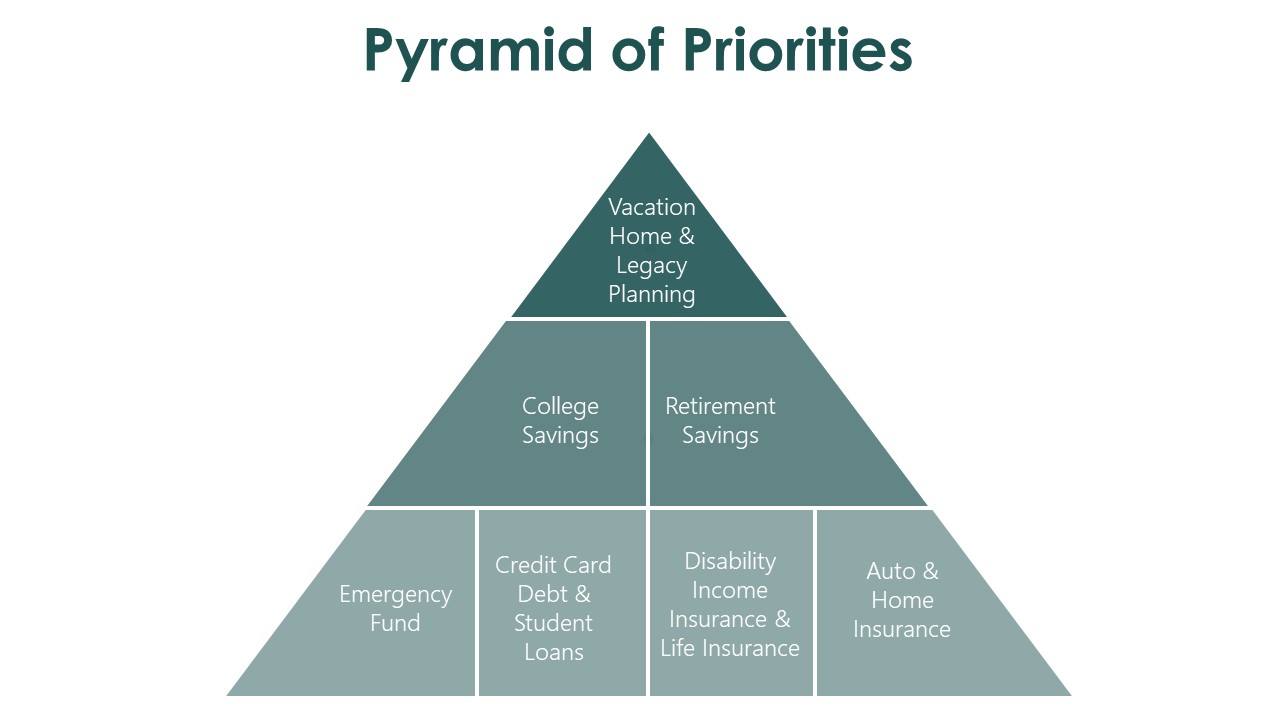

One of the most effective is building your financial planning pyramid of priorities, a step-by-step framework for deciding where to focus your time and money.

The financial planning pyramid is a structured framework that organizes your financial goals in order of importance, starting with basic needs like an emergency fund and progressing to long-term goals like alternative investments.

The pyramid of financial planning helps ensure you prioritize essential protections and savings before moving on to higher-risk or discretionary investments.

Over years of working with clients, we’ve found that one of the biggest challenges in achieving financial goals is figuring out which steps to take first, and in what order.

Clients often ask:

The financial plan pyramid provides clear guidance on these decisions by laying out a logical sequence, helping you stay focused on the right priorities at the right times.

Let’s walk through the different sections of the pyramid to help you understand this concept further.

Before accelerating debt repayment, buying a home, or increasing investments, focus on building a cash reserve that covers 3–6 months of living expenses. This emergency fund provides a cushion that protects you from unexpected costs, such as medical bills, car repairs, or travel emergencies.

Pro tip: Keep your emergency fund in an accessible, interest-bearing account separate from your everyday checking account.

Once your emergency fund is in place, focus on paying off high-interest debt, typically credit cards or certain personal loans. If you have student loans, ensure you’re using the most effective repayment strategy for your situation, whether that involves refinancing, applying for forgiveness programs, or exploring other options.

Choosing the wrong debt repayment plan can cost you thousands over time, so carefully review your choices.

With a solid foundation established, the next step is protecting your most valuable asset: your ability to earn an income. This includes having appropriate insurance, such as:

Protecting your assets by purchasing insurance that aligns with your debts, goals, and income projections will keep you protected while you address your short-term goals and pay off any debts.

Once you’re protected, you can focus on building long-term wealth through retirement accounts, college savings plans, or other investments. Setting up automatic contributions helps make saving a regular habit instead of a decision you have to revisit each month.

With the earlier steps covered, you may be in a position to explore opportunities such as:

These ventures usually involve more risk, so they tend to work best when supported by a solid financial foundation.

Many purchases can be a distraction from or obstacle to your financial goals, especially if you haven’t laid a solid foundation with an emergency fund and asset protection. But how do you determine your top financial priorities in the first place?

Write down both short-term (within 1–3 years) and long-term (5+ years) goals. Be clear and realistic.

A net worth statement shows the difference between what you own (assets) and what you owe (liabilities). Tracking your net worth over time helps you see your progress toward financial independence.

A budget (focused on future plans) is different from a cash flow statement (based on past records). It allows you to plan ahead for where your money will go, helping you prioritize your expenses without guesswork.

We recently sat down with Natalie and Mark Smith, who are at a crossroads in their financial journey and came to us with the following questions:

The pair identified their most important goal for the next 12 months as saving for college for their 3 and 6-year-old children. They don't want their children to feel burdened with student loans like they did and do.

With that said, let's look at their balance sheet and their budget.

Here’s their balance sheet, which outlines all of Natalie and Mark’s assets and liabilities.

| Assets (what we own) | Liabilities (what we owe) | |||

| Checking Account | $45,000 | Auto Loan | $40,000 | |

| Money Market Account | $55,000 | Mortgage | $640,000 | |

| Automobile | $80,000 | Student Loans | $180,000 | |

| 401(K) | $750,000 | |||

| Roth IRA | $80,000 | |||

| Home | $800,000 | |||

| Total Assets | $1,810,000 | Total Liabilities | $860,000 | |

Usually, people don’t omit things on a balance sheet as easily as they would on a budget. But, since a balance sheet only shows values at a specific point in time, it’s very important to know how these figures are changing.

For example, what was the balance in their checking account six months ago? Was it higher, and have they been slowly using up their surplus? Or was it lower, and they’ve slowly been building some cash reserves?

Now that we have these figures in mind, let’s take a look at their budget, which will give us a more complete picture of their expenses.

Take a look at Natalie and Mark's expenses. What observations do you have? Are there any expenses they might be forgetting but should plan for?

| Income | |

| Salary | $30,000 |

| Household Expenses | |

| Mortgage | $6,000 |

| Phone/Cell | $120 |

| Electric/Gas/Oil | $250 |

| Water | $100 |

| Cable/Streaming/Internet | $250 |

| Transportation | |

| Car Payment | $700 |

| Maintenance & Repair | $100 |

| Gas | $250 |

| Lifestyle Expenses | |

| Groceries | $2,000 |

| Eating Out | $1,000 |

| Personal (i.e., Target) | $600 |

| Insurance | |

| Automobile | $200 |

| Loan Expenses | |

| Student Loans | $1,800 |

| Total Net Income | $30,000 |

| Total Expenditures | $13,250 |

| Surplus/Shortage | $16,630 |

This is an example of a monthly budget

They haven’t yet accounted for things like vacations, gifts, or even haircuts. Remember that even though these are variable expenses and often lower on the spending priority — unless you plan to completely cut them out — you need to account for them in your budget.

Now, we’ll need to adjust some of the other items to accommodate these expenses.

| Income | |

| Salary | $30,000 |

| Household Expenses | |

| Mortgage | $6,000 |

| Phone/Cell | $120 |

| Electric/Gas/Oil | $250 |

| Water | $100 |

| Cable/Streaming/Internet | $250 |

| Transportation | |

| Car Payment | $700 |

| Maintenance & Repair | $100 |

| Gas | $250 |

| Lifestyle Expenses | |

| Groceries | $2,000 |

| Eating Out | $1,000 |

| Personal (i.e., Target) | $600 |

| Travel | $2000 |

| Gifts | $150 |

| Haircuts | $300 |

| Insurance | |

| Automobile | $200 |

| Loan Expenses | |

| Student Loans | $1,800 |

| Total Net Income | $30,000 |

| Total Expenditures | $15,820 |

| Surplus/Shortage | $14,180 |

Subtracting their total expenditures from their total net income results in their surplus or shortage.

After adjusting their budget to include their additional variable expenses, Natalie and Mark's surplus is around $14,000. This surplus is what we’ll use to help them build their net worth.

By reviewing Natalie and Mark's balance sheet and budget, we were able to help them create an action plan to achieve their goals.

The couple’s primary short-term goal is to start funding college accounts for their children. Looking at the information above, they have not started and have about $14,000 of discretionary surplus available each month.

Using this information, there are many possible strategies to help the couple make progress toward their goal. Here are a few ideas in chronological order, using our pyramid of priorities.

Through broader financial planning, we identified that Natalie and Mark are severely underfunded as it relates to life insurance and disability income insurance. If one of them lost their job or was unable to earn an income, their entire financial situation would change drastically.

Pursuing these foundational levels of coverage takes priority over saving for college.

Now that they have the appropriate protection plan in place, we look at their student loans. They had recently refinanced their loans at low interest rates with 10-year payment options. The optimal strategy was identified to continue down their current repayment plan.

Since the foundation levels of the pyramid are addressed, we can then identify the appropriate college savings plan for their children.

Through our conversation, they shared that they'd like to fund 4 years of undergraduate school for both children (at any school). We agreed on monthly contributions of $750 per child, thereby reducing their cash flow surplus by $1,500 per month.

Each of these steps has its pros and cons; Natalie and Mark have to carefully weigh them against each other to decide the best plan of action.

Once they saw their chosen strategy working to help increase their long-term probability of success, they were able to make more confident decisions about implementing their plan.

The first step in the financial planning pyramid is building an emergency fund that covers 3 to 6 months of living expenses. This creates a financial cushion for unexpected costs.

Yes, in some cases you can work on multiple levels simultaneously, but it’s important to secure your foundation — emergency fund, debt repayment, and insurance — before committing significant resources to higher-risk goals.

The pyramid prioritizes paying off high-interest debt early, ensuring you reduce costly interest charges before directing funds toward long-term investments. That said, having adequate cash reserves is equally important.

Your financial plan, much like a pyramid, must be built from the ground up, with the most important goals forming the foundation of your plan and then working up. Without the basics in place, higher-level goals can collapse under pressure.

That’s why we created the 5 Steps to Organize Your Finances Checklist to help you organize and prioritize your goals. Download your free copy now.

CRN202808-9307537

Jordan Bilodeau, CFP®, CEPA, is the Director of Planning & Strategy at Spaugh Dameron Tenny, where he leads firmwide planning initiatives and helps clients navigate complex financial decisions. With experience in portfolio design, tax strategies, and business succession planning, Jordan works with executives, physicians, dentists, and successful retirees to coordinate every aspect of their financial lives. He holds both the CERTIFIED FINANCIAL PLANNER® and Certified Exit Planning Advisor designations and has a Master’s degree in Wealth and Trust Management, providing tailored guidance for clients.

Finance has a reputation for being complicated, and not without reason. Like many specialized fields, it comes with its own language, acronyms, and ...

Read More →If I had a dollar for every time a new client made one of the comments below, I’d have … well, a lot more dollars.

Read More →At Spaugh Dameron Tenny, part of our role is helping clients start each year grounded in facts, not headlines, assumptions, or half-answers. When ...

Read More →