Your employer may have group disability insurance (sometimes called business disability insurance) available. As a physician or dentist, you need to determine if that coverage is sufficient to protect your finances and your family if you suffer an illness or injury that prevents you from working.

Your ability to earn an income is your most significant financial asset. Not having the proper protection in place if you become disabled can jeopardize this asset.

If you were to lose your primary source of income, what would happen? Are your financial plans around mortgage payments, debt management, retirement planning, and education savings going to fall by the wayside? Do you have a plan ready in case this happens to you?

If you cannot work due to an accident, injury, or sickness for an extended period of time, disability insurance can replace a portion (typically 60% to 65%) of your income. Keep in mind that the types of coverage and the length of time you’re unable to work impact this amount.

Let's start at the beginning. Group disability insurance is typically covered by a company as an added benefit.

Group disability benefit plans are guaranteed issue, meaning if you apply for coverage, you will be automatically enrolled. There is little to no medical underwriting.

On the surface, your group disability insurance coverage can seem like a good benefit. However, group disability plans are generally not sufficient for most physicians.

A client of ours asked if we would help one of his co-workers by reviewing and determining what his disability benefit would pay as his friend was now disabled.

One day his friend woke up and was blind in one eye and was experiencing issues in his other eye. It was evident his work would be affected, and he may be unable to return to work for the foreseeable future. He tried to decipher the policy details but admitted the wording was very confusing. He knew he needed to wait 180 days before being able to collect on a claim, but beyond that, he was unclear how much he should expect to receive and at what cadence.

After we reviewed his policy, it looked like the first 12 months he would receive disability benefits based on a loss of earnings calculation. His benefit would pay him 60% of his income with a maximum monthly amount of $10,000.

Following 12 months of payment, his policy changed from a loss of earnings contract to a reduction in benefit definition. Without going through all the calculations, his monthly benefit would default to the "policy minimum" payout of $100 per month.

Do you think this client would have planned differently if he knew this before becoming disabled? Unfortunately for him, it was too late to do anything about it.

So, what more do you need to know about group disability insurance…?

There are various contract features you should be mindful of, including potential impacts of filing a claim:

Before you need to use your group insurance policy, it is crucial to understand what coverage is available and how it would impact your finances if you could not work.

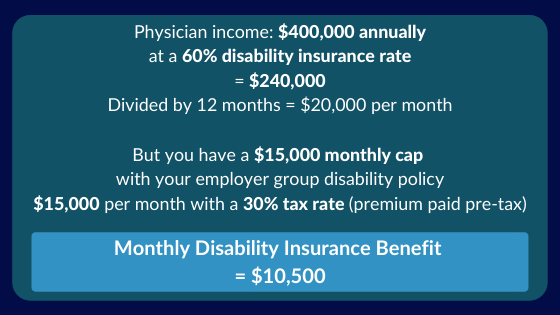

Let's suppose a physician is making $400,000 a year, and their employer provides a disability benefit of 60% of their income with a monthly maximum of $15,000.

If the answer is yes, then perhaps you’ll be fine with only your group disability insurance. However, if your answer is no, then you should consider adding additional coverage to make up the difference.

Keep in mind that insurance companies limit their exposure based on how much disability they offer you. They want there to be an incentive for you to go back to work. Typically, you can get 60% to 65% of your pre-disability income covered with individual supplemental disability insurance, and that's on an after-tax basis.

In the example above, the doctor would be able to receive an additional $8,000 - $10,000 monthly benefit with a supplemental disability insurance policy. The benefit would not be taxable as you would be paying the premium personally with after-tax dollars.

So, what should you know about individual disability insurance…?

You can purchase an individual disability insurance policy to either supplement a group plan's shortfalls or provide coverage if a group plan is not available.

Features of individual coverage include:

Ensuring you have enough income to support your family in the event that you suffer an injury or illness and cannot work for an extended period of time is an essential part of any financial plan. One of the best ways to protect yourself as a physician or dentist is to have disability insurance coverage.

Our team is here to guide you and offer assistance. Let's talk about what disability insurance could mean for you and your future. Please reach out to our financial planners at SDT once you’re ready to buy disability insurance.

A disability income policy has exclusions and limitations. For costs and complete details of coverage call 704-557-8750.

CRN202304-281346

John Dameron has been a financial planner and partner with Spaugh Dameron Tenny since 2002. With the help of the SDT team, John created a lecture series called Physicians Financial Focus, authored a book entitled The Residents and Fellows Financial Survival Guide, and has coached hundreds of physicians from residency/fellowship into practice. His expertise has also been featured on KevinMD.

For doctors and their spouses, the life insurance application process can feel daunting and invasive as you may endure answering very personal ...

Read More →Life Insurance Considerations for Doctors In Training September is Life Insurance Awareness Month (LIAM). How will you protect your biggest asset — ...

Read More →Since you were in medical school, it has probably been drilled into your head that you must have disability insurance. Your ability to earn an income ...

Read More →