.png?width=560&name=Blog%20Banner%20%26%20Thumbnails%20(13).png)

Nobody wants to take a 40-60% pay cut if they become injured or go on maternity leave – especially after a decade of training plus thousands of dollars of medical or dental school costs.

Most employers provide short-term and long-term disability insurance as part of benefits packages they offer to employees. Employer or group disability insurance policies are great to have if an injury hinders your ability to see patients or perform surgery, but it probably doesn’t cover your full income. Many group plans only cover 60% (or less) of your income, which may be closer to 40% when taxes come into play.

Supplemental Disability Insurance for doctors, also called individual or private disability insurance, can help you bridge the income gap and reach 80% of your income, which is more manageable if you become injured, sick or disabled.

You might be thinking, “Now why in the world would I need to be thinking about that? I’m a young healthy person. I’ve never had any health issues.This isn’t something I need to be thinking about now. Maybe I can start thinking about it when I get older.”

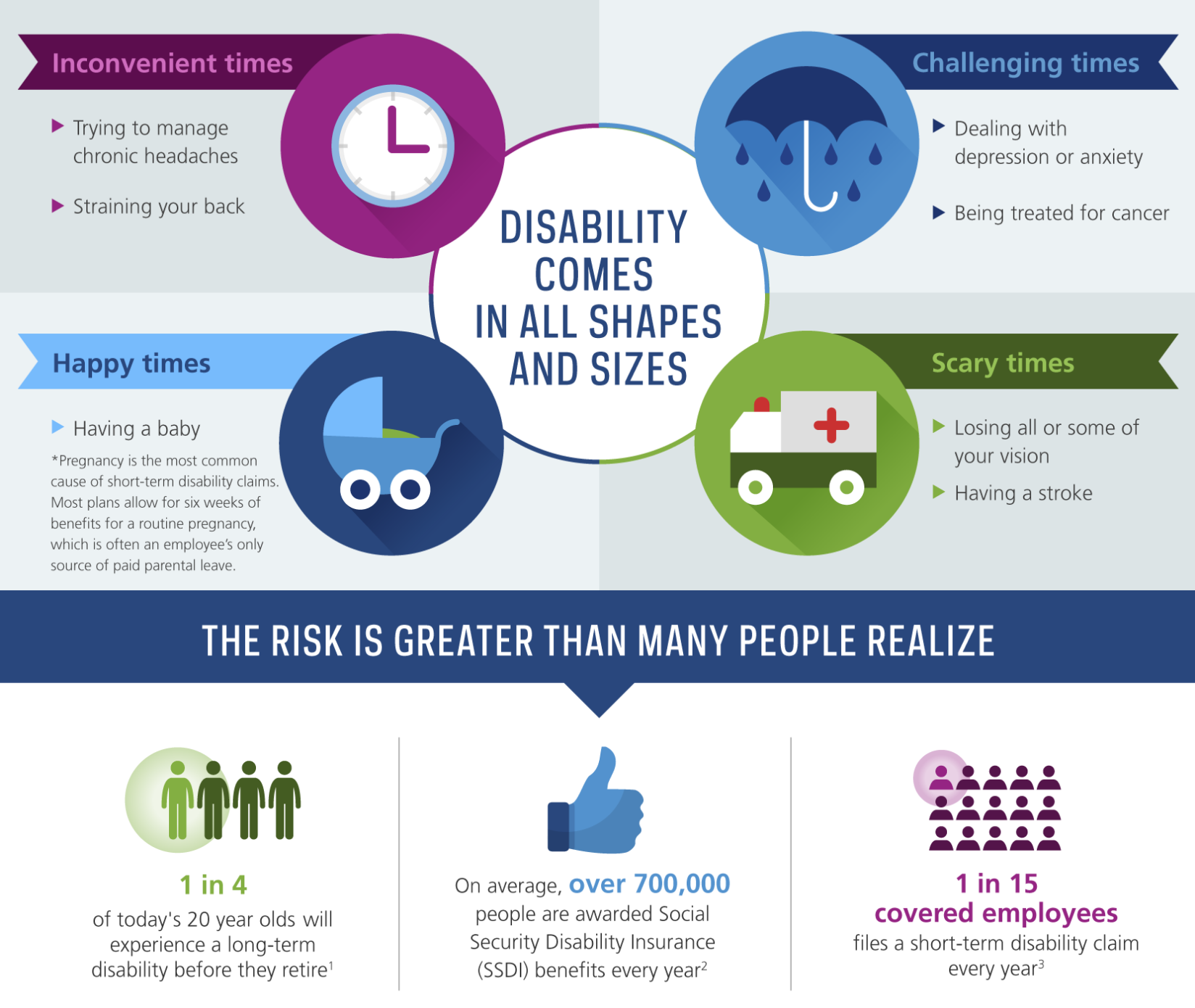

The truth is that it’s never too early to start planning for your health. Disability insurance for doctors is critically important. You may not think that anything may go wrong but look at this list of common things you see and treat every day, as a doctor.

This infographic below shows disability comes in all shapes and sized. Check it our for more specific statistics.

Supplemental disability insurance is a type of insurance that insures a portion of your income. Much like auto insurance protects your auto and home insurance protects your home, disability income protects a portion of your income lost to disability, illness or injury. Disability income insurance ensures that money keeps coming into your household to pay the bills if you are unable to work and earn a living due to an accident or an illness.

To understand how disability income insurance works, let’s look at a case study.

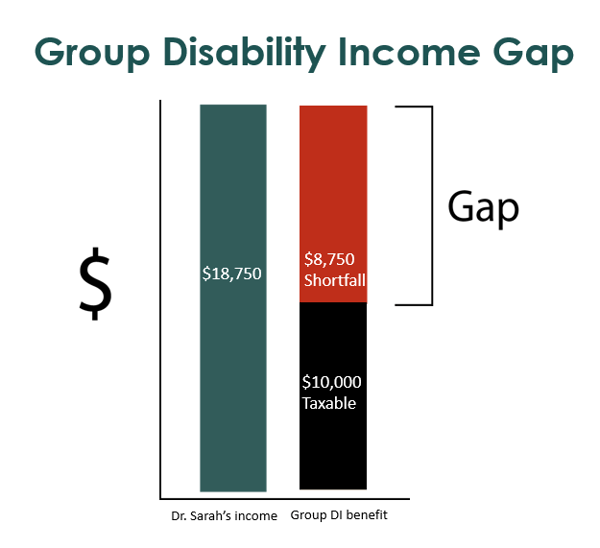

Dr. Sarah has recently graduated and has a job as an OB/GYN physician with Lexington hospital making $225,000 a year, and she has a group disability insurance policy. This means that the hospital (at no cost to her) has a group plan so that if she were unable to work because of an illness, a medical condition or an accident, they would pay her a portion of her income for a prolonged period of time. Sarah will be making a long-term disability claim in this scenario. See her income in the image below.

In her case, the group plan would cover 60 percent of her earnings and they would pay that to her for up to age 65. The other caveat with the group plan is that they would pay no more than $10,000 a month, regardless of what 60 percent actually works out to be.

As you can see here in the graph above, her normal income is $18, 750 per month. If she files a disability insurance claim, 60 percent of her $225,000 annual salary is $135,000. On a monthly basis this would equate to $11,250 dollars.

$135,000 ÷ 12 months = $11,250 per month

If Sarah were to be unable to work – instead of earning $18,750 each month – she would not earn the full $11,250 because she would hit that cap of $10K a month, resulting in a significant loss in income.

Furthermore, it’s important to note that that $10k per month is still treated as taxable earnings to her, so after she pays income taxes, her take home pay would be closer to $6-7k per month. Would this be enough money to comfortably cover her monthly expenses like your mortgage, groceries, utilities, car payment, child expenses, etc?

For most disability insurance claims, the disability income starts after an elimination period. For a typical short-term disability plan, it can start paying you 7-14 days after your injury or illness, while long-term disability has an elimination period of 90 days or longer.

In Sarah’s case, her disability benefit of $10K per month won’t start until after she has been unable to work for three months. The check typically comes at the END of the fourth month, so that is one of the reasons we always recommend having an adequate emergency fund.

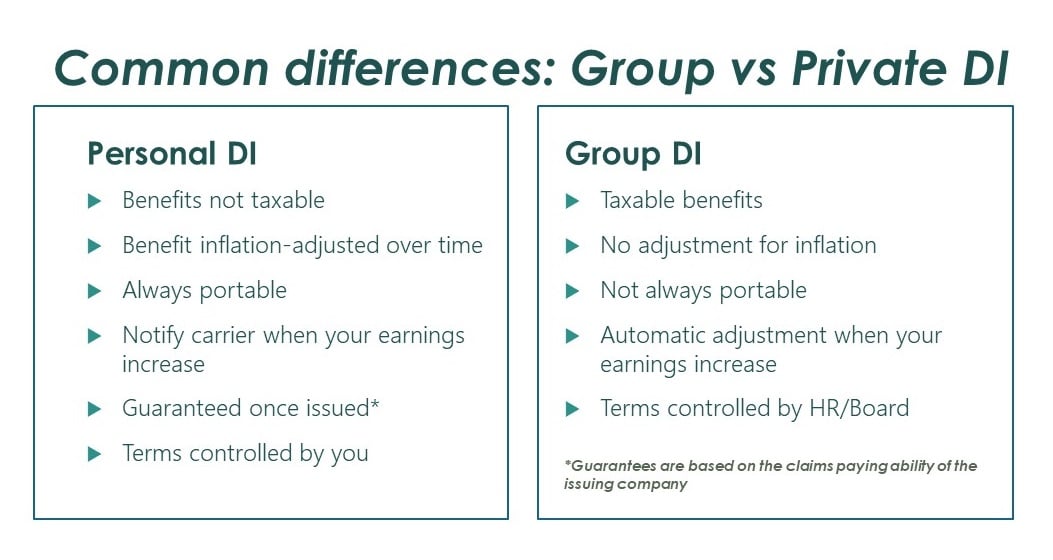

Although most disability insurance claims last about 34.6 months, long-term disability can also happen due to early onset Alzheimers, musculoskeletal issues or other unforeseen events. Whether the disability claim lasts 2 years or 20 years, Sarah’s cap of $10K per month does not change. There is NO adjustment for inflation, no adjustment for Cause of Loss (COL). This static disability income benefit is a characteristic that is frequently true of group disability insurance, which is not the case with private or personal disability income insurance.

With private or supplemental disability income insurance, there is much more flexibility in how the policy is designed, to account for inflation, future earnings, and other important factors.

Let’s take Dr. Sarah’s scenario a bit further. What happens if she is out of work for a period of 6 or 9 months, comes back to work, but she is not able to practice full time? Let’s say her illness or disability keeps her from doing the same duties she was once able to do as an OB/GYN. She is not able to move up and down the halls of the hospital taking calls and delivering babies, but she is still able to sit in an office and do gynecological work. Her job title and duties might change, resulting in a reduction in her income.

The good news is she is well enough to can go back to work; the bad news is that she will never make $225k again. Now, she may be making $150K in her new role. With group DI, we frequently see the benefits go away entirely once clients return to work, whether they can work in the same or reduced capacity. A benefit of having private insurance is you can often have the benefit reduced proportionately. This means the insurance company pays you some income to supplement your reduced earnings.

A combination of group and supplemental disability insurance can help you keep more of your monthly income and receive $15,000 instead of $10,000 (pre-tax) in the event of an injury, illness, or disability.

Let’s review the common differences between the two.

Understanding how disability insurance works can leave you wondering where to go from here. There are a lot of decisions to be made around disability income insurance.

Private insurance policies often offer many different types of ‘riders’ which are optional benefits available at an additional cost. Examples of riders are Own Occupation rider, Partial Disability coverage, retirement savings coverage, recovery benefits, etc. it can become overwhelming.

Which Disability Insurance carrier should you choose? To name a few, there is Metlife, Principal, Standard, Massachusetts Mutual Life Insurance Company (MassMutual), Unum, Guardian, or Northwestern Mutual.

During your research,you have probably noticed there are many nuances to be aware of when choosing the right carrier. It’s important to consider your big picture financial plan. To begin, start by asking yourself these questions:

A financial planner is someone who can help you with your insurance strategy -- based on your career, your employment situation, your health – they can help you find the right company and the right combination of benefits to help protect your future earnings.

If you have any questions about disability income or other insurance planning, schedule a complimentary call with one of our financial specialists, John Dameron!

A disability income policy has exclusions and limitations. For costs and complete details of coverage call (704)557-9750). CRN202208-270085

John Dameron has been a financial planner and partner with Spaugh Dameron Tenny since 2002. With the help of the SDT team, John created a lecture series called Physicians Financial Focus, authored a book entitled The Residents and Fellows Financial Survival Guide, and has coached hundreds of physicians from residency/fellowship into practice. His expertise has also been featured on KevinMD.

Whether you're launching your career, navigating a major life change, or preparing for retirement, it's never too early or too late to benefit from ...

Read More →This year, April 15th is the deadline to file your 2024 tax return, and it is quickly approaching. Whether you work with a CPA or another trusted tax ...

Read More →For those with significant financial success, a bonus represents more than just extra income. It’s a chance to create meaningful progress toward your ...

Read More →