Retirement planning should start at the onset of your professional career. Like many things in finances, the earlier, the better. Many residents and fellows have the option to save into a retirement plan and receive matching contributions even during their training. Over the next 30-plus years as a medical provider, your investment returns will play a role in your preparedness for retirement, but returns are not the only important variable. You’ll also have to manage your lifestyle expenses, retirement savings, and many other aspects of creating a sound plan for retirement.

A risk that many have become familiar with over the last 15 years is called the – Sequence of Returns Risk (SORR). That is, the risk a late-career professional or early-retiree will experience negative investment returns. The risk becomes more prominent later in your career since it gives you less time to make up for losses that may also be compounded by account distributions.

Many people have heard horror stories of friends and family members trying to retire during the 2008 Financial Crisis. The reason these horror stories exist is due primarily to the sequence of returns risk.

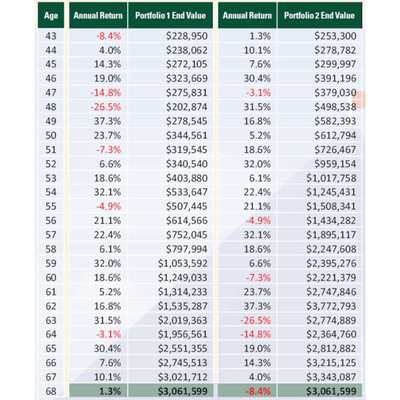

Take two mid-career investors, in which both investors have a portfolio size of $250,000 at age 43. Over the course of the next 25 years, each investor received the same returns but in the opposite order. Here are their investment results (utilizing the S&P 500 Index as their investment):

Since both Investors were in the Accumulation Phase of their retirement planning, both ended with the exact same account value despite the order in which their returns were received.

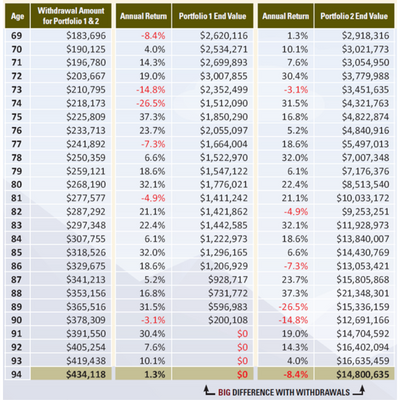

Now, take those same two investors. Both are now at retirement and require annual distributions equal to 6% of their portfolio in the first year, with 3.5% increases annually thereafter. Both investors start with a portfolio of $3,061,599.

As you can see, the order in which the investors receive their investment returns during their Distribution Phase of retirement planning becomes much more critical during periods of withdrawals due to the sequence of returns risk. In the example above, the first investor runs out of money, and the second investor has a portfolio valued at $14,800,635, despite having taken withdrawals of more than $7,500,000.

This sequence of returns risk is real and can have a long-lasting emotional and financial impact on some of the best years of your life.

As you approach retirement, the risk within your portfolio or often the exposure to stocks isn’t required to be the same as it was at the onset of your career. Therefore, as you near your retirement date, it becomes much more important to review your portfolio allocation to determine if you are aligned appropriately with your goals. This phenomenon occurs automatically in many employer-sponsored retirement plans such as 401(k), 403(b), 457(b), or 401(a) plans if you are utilizing a Target Date Fund. For example, the allocation of a Target Date fund for someone who is 35 years away from retirement often has 90% exposure to stocks. In contrast, someone who is within five years of retirement has approximately 55% exposure to stocks. In addition, not all investments or mutual funds adjust their exposures over time. Therefore, it’s imperative that you review and fully understand how your accounts are allocated.

In 1978, Congress passed the Revenue Act of 1978, allowing employees to defer their income to a Section 401(k) plan. Prior to this, most employers offered pension plans. Today, and for the last many years, this means the responsibility for retirement income planning has shifted from an employer's responsibility to an employee's responsibility. Therefore, it’s vitally important to determine whether you are comfortable with the potential for a variable retirement income plan (taking distributions from investment accounts as needed) or if you’d prefer more stability in your income planning during retirement. Although pension plans are nearly extinct, there are other solutions available to help retirees receive stable income throughout retirement.

An additional way to reduce your sequence of returns risk would be to utilize a bucket retirement income planning strategy. That is, to maintain adequate cash reserves to supplement one to three full years of your needed retirement income. Of course, this does create other risks but can help prevent the sequence of returns risk by using cash reserves during volatile market years and then replenishing your cash reserves once your investments have recovered.

It’s impossible to predict the future or foretell what the market environment will be when you are ready to retire. Yet, if you plan to take systematic withdrawals from your accumulated assets, timing can profoundly affect your ability to sustain your income.

Not sure where to start with your retirement income planning or simply saving for retirement. Connect with one of the financial planners at SDT to begin building a plan to help you reach your goals.

Disclosure: The illustrations above are hypothetical and for illustrative purposes only and are not representative of any product. The Standard & Poor’s 500 Composite Index (S&P 500) is an unmanaged index of 500 commons stocks generally considered representative of the U.S. stock market. Indexes do not consider the fees and expenses associated with investing, and individuals cannot invest directly in an index. Past performance is no guarantee of future results.

CRN202506-2504342

Jordan Bilodeau, CFP®, CEPA, is the Director of Planning & Strategy at Spaugh Dameron Tenny, where he leads firmwide planning initiatives and helps clients navigate complex financial decisions. With experience in portfolio design, tax strategies, and business succession planning, Jordan works with executives, physicians, dentists, and successful retirees to coordinate every aspect of their financial lives. He holds both the CERTIFIED FINANCIAL PLANNER® and Certified Exit Planning Advisor designations and has a Master’s degree in Wealth and Trust Management, providing tailored guidance for clients.

It's common to see blogs and articles touting the wonders of Roth IRAs. When you understand the tax characteristics of this particular type of ...

Read More →Physicians change jobs more often than many people realize, whether by moving between hospital systems, transitioning to a VA hospital, joining a ...

Read More →As required minimum distributions (RMDs) begin, many retirees are surprised by how quickly taxable income rises, even when their spending needs ...

Read More →