Social Security seems to always get a lot of press, at least in the financial media. For many years, there have been questions on whether the program is adequately funded. Modern medicine has increased life expectancies through the last several decades, putting additional strain on the Social Security system since people are receiving their benefits for longer. Despite the questions and confusion related to the funding of Social Security retirement benefits, here are some vital takeaways.

To get your statement, you can do so relatively easily through my Social Security. First, you'll want to create an account if you don't already have one. However, creating one is not required. If you don't have an account, the Social Security Administration will mail you a statement when you are 60.

For many, Social Security is the foundation of retirement planning with the reduction of pension plans available nowadays. In addition, Social Security may prove to be one of the few sources of guaranteed income a lot of couples receive during retirement.

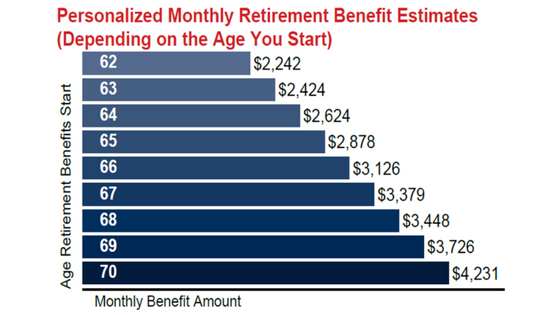

Understanding what the numbers on your statement mean is next in order of importance. The first thing that will jump out to you as you view your Social Security statement is the estimated benefits bar graph. As seen below:

The bar graph illustrates precisely how much benefit you could expect, assuming you continue to earn a similar level of income per year until you start your benefits. So, for example, someone earning $142,800 should continue to make that same income amount to expect the benefit estimates above.

One critical takeaway from the graph above is the growth of the benefits over time. For those born after 1960, the full retirement age for Social Security is 67. But you can elect to take benefits sooner or delay benefits. Here's what it could mean for you:

In the case of early retirement, social security benefits are reduced 5/9 of one percent for each month before the normal retirement age, for up to 36 months. If the number of months exceeds 36, the benefit is further reduced by 5/12 of one percent per month.

For example, if the number of reduction months is 60, which is the maximum number for retirement at 62 when the standard retirement age is 67, then the benefit is reduced by 30 percent. This maximum reduction is calculated as 36 months times 5/9 of 1 percent plus 24 months times 5/12 of 1 percent.

For every year you delay taking Social Security retirement benefits, your benefit increases by 8%. So, for instance, for someone at the full retirement age of 67, if they wait until 70, which is the longest someone can wait, they will earn an 8% benefit increase for three years.

The statement is intuitive but fails to include three essential pieces of information.

1. The statements don't include any form of Medicare Part B premiums which will be automatically deducted once you've enrolled in Social Security and Medicare. In 2022, Medicare Part B premiums start at $170.10 per month.

2. Related to Medicare Part B premiums, the statements also don't reflect the income-related monthly adjustment amount (IRMAA) that applies to Part B premiums. As a result, monthly Part B premiums can be as high as $578.30 per month based on your modified adjusted gross income.

3. The statements also omit information related to the windfall elimination provision (WEP) and the government pension offset (GPO). Both offsets are related to previous earnings not covered by social security. Therefore, you may want to research WEP and GPO further if you receive a pension from earnings not covered by social security.

Social Security is designed to help retirees replace their earned income with guaranteed retirement income. However, with that said, Social Security does not have a hard and fast rule on replacing the same percentage of everyone's income. That's because the program includes a wage base. This means high-income earners do not pay social security tax on all their income; they simply pay the tax up to the social security wage base, which is $147,000 for 2022.

For example, those earning $300,000 or $500,000 per year are paying the same amount of social security tax as those earning $150,000 per year. Based solely on this fact, both should expect the same social security retirement benefits since they are both above the social security wage base ($147,000). Other factors such as their previous work history, age, and benefits start date will also impact their calculated benefits.

Social Security retirement benefits will replace a higher percentage of someone's income if they were earning $75,000 per year during their working years compared to someone earning $300,000 per year. This is because the lower income earner paid Social Security tax on 100% of their wages. In contrast, the higher income earner only paid Social Security tax on approximately 50% of their wages (based on the 2022 wage base).

If you're unsure whether your earnings exceeded the social security wage base, your earnings taxed for Social Security can be found on Page 2 of your Social Security statement in a table format.

The Social Security Administration recommends that individuals verify the information within their social security statements. This includes but is not limited to the birthday, name, and previous year's income verification.

If you discover errors or earnings that are missing, you should (1) find proof of those earnings and (2) contact the Social Security Administration to correct the errors.

If you have any questions related to when to file for social security, the taxation of social security, or want to understand your preparedness towards retirement better. Click here to get in touch with one of our financial planners, that can help answer your questions.

CRN202510-3210147

Jordan Bilodeau, CFP®, CEPA, is the Director of Planning & Strategy at Spaugh Dameron Tenny, where he leads firmwide planning initiatives and helps clients navigate complex financial decisions. With experience in portfolio design, tax strategies, and business succession planning, Jordan works with executives, physicians, dentists, and successful retirees to coordinate every aspect of their financial lives. He holds both the CERTIFIED FINANCIAL PLANNER® and Certified Exit Planning Advisor designations and has a Master’s degree in Wealth and Trust Management, providing tailored guidance for clients.

A Roth IRA is a tax-advantaged individual retirement account that allows qualified withdrawals to be made tax-free. Unlike a Traditional IRA, Roth ...

Read More →At Spaugh Dameron Tenny, part of our role is helping clients start each year grounded in facts, not headlines, assumptions, or half-answers. When ...

Read More →Understanding how much you can contribute toward retirement each year helps you stay on track with long-term financial goals and avoid surprises at ...

Read More →