Do you feel anxious about your student loans? You’re not alone.

Did you know that borrowers in the United States hold a collective $1.6 trillion in student loan debt? Individuals with a bachelor's degree have an average of $30,000 in student loans, and medical/dental school graduates owe close to $300,000.

Even though this may seem daunting, there are strategies to help you reduce your debt. Tactics like forbearance can delay payments, while others such as the Public Service Loan Forgiveness (PSLF) can forgive the remaining debt. In this guide, we will walk you through the different student loan repayment options.

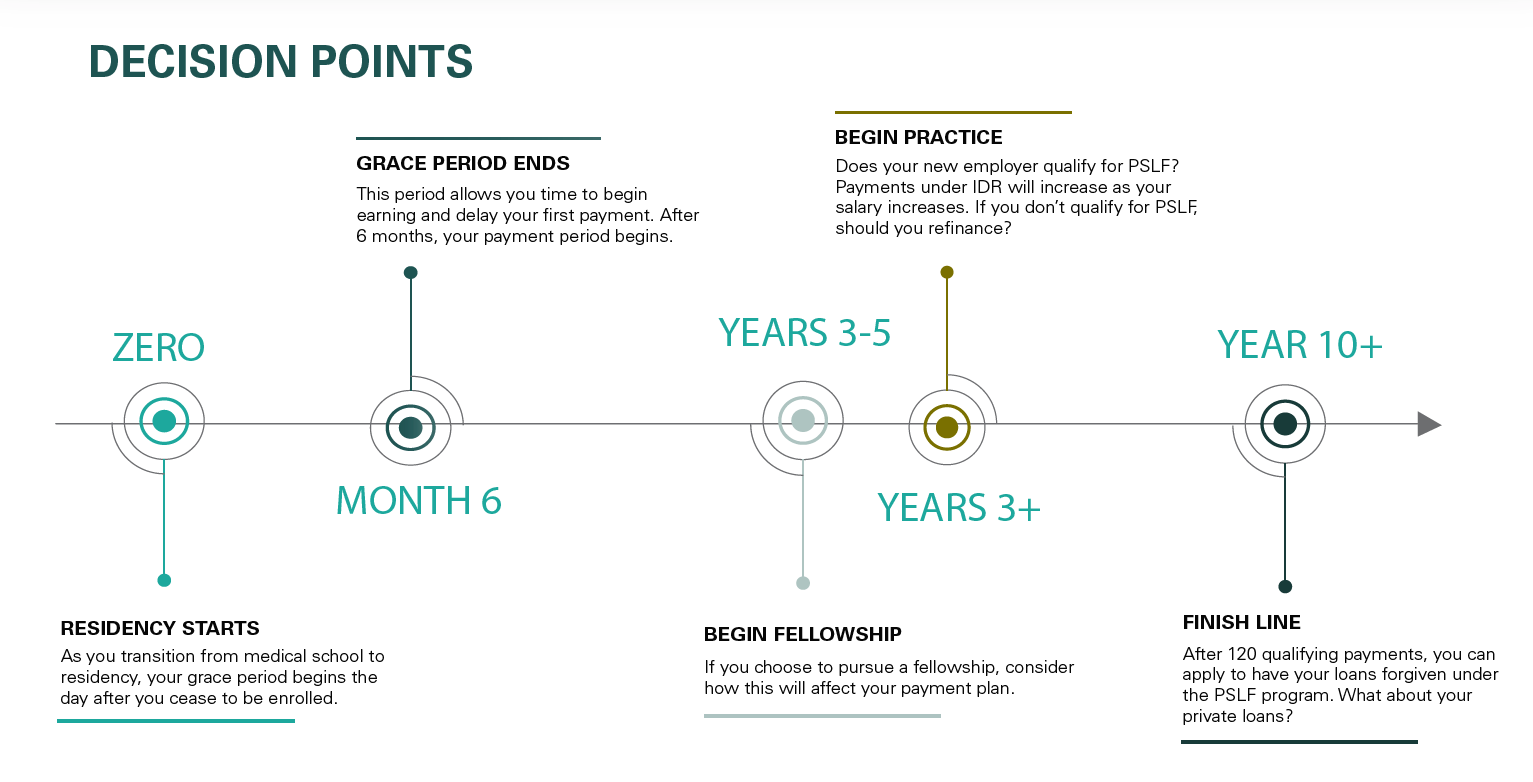

This graph should give you an idea of payment timelines from residency. It's time to start paying off your student loan debt!

As you probably know, you have a long road ahead of you if you’re a medical or dental student. Following four years of medical or dental school, your training can last anywhere from 3 to 7 years. Because graduate programs can be very demanding, it can be hard to make time to make money during this time.

Forbearance lets you temporarily delay your loan payments or make smaller ones. In contrast to private lenders, it can be easier to put federally subsidized loans into forbearance.

Because interest still accumulates on your loan, your total loan balance will increase. To prevent paying more in the long-run, you can put excess capital towards your loan.

Income Driven Repayment (IDR) plans cap your monthly payment to a fixed percent of your discretionary income. This is usually around 10-20%. The main income-driven plans include IBR, PAYE, and ICR.

If you have government-backed loans, you can look into (IDR) Income Driven Repayments. Examples of these loans include Direct, Perkins, Stafford, and Grad Plus options.

Income-based repayment options are one of the best benefits of having government loans. Depending on which IDR option you choose, you can cap your payments at 10-20% of your discretionary income.

To qualify for IDR, you must exhibit partial financial hardship when first applying. You must also verify your family size along with your annual income.

You can also use this calculator to determine your monthly payment amount. Keep in mind that any forgiven balance after 25 years is taxable income. (Be sure to consult a tax or financial professional for advice on managing potential tax liabilities.)

PAYE or Pay As You Earn is similar to IDR, but it caps your payment at 10% of your discretionary income. It offers forgiveness after 20 years of payments, and you must have taken a federal loan out after October 1st. 2007.

ICR or Income Contingent Repayment is a good option if your applications for other income-based repayment plans were rejected. It’s the only income-based repayment option available for Parent PLUS loans, but they must be consolidated first to qualify. Payments are the lesser of 20% of your discretionary income or monthly payments when the loan is amortized over 12 years. Its forgiveness term is 25 years.

Deferment is like forbearance, as you can use it to pause payments. However, you have to meet certain criteria, like being unemployed, in the military service, or if you're facing other tough financial times. Graduate students also qualify for deferment. You also have to apply for deferment with each lender, which will make the process longer if you work with various lenders.

Luckily, the government will pay the interest on your government-subsidized loans during this period. Yet, you’ll still be responsible for accumulating interest on your private loans.

One of the biggest things to avoid when making income-driven repayments is going into credit card debt. To avoid going into credit card debt, get ahead of or keep up with student loan repayment options. Secured credit cards have interest rates that fluctuate around 18%, which will double your debt in 4 years, per the Rule of 72.

The Rule of 72 will show you how many years it will take your investment or debt to double by dividing 72 by your interest rate or rate of return. This is a rough estimate, but it can show you how compounding interest can help or harm you.

Once you’re a resident or fellow, you’re starting to earn a decent salary. Regardless, be mindful of your budget, avoid credit card debt when possible, and look into income-driven repayment options, including IBR, PAYE, and ICR. Income-based repayments will make your monthly payment more manageable and eventually forgive your remaining debt, which will likely be considered taxable income.

As mentioned earlier, your interest rate can make a huge difference when considering student loan repayment options. Refinancing can be a useful tool to save on interest. Yet, you should be aware of the pros and cons when refinancing.

If you owe $200,000 at 7% and refinance to 6%, then you’d save $12,000. This assumes that you’d pay off your debt in 10 years and you can use this calculator to calculate your own scenarios.

This can be seen as a pro and con, as your interest rate won’t increase as long as you choose a fixed-rate loan rather than a variable or hybrid loan. But refinancing student debt is irreversible, so think hard before signing the dotted line. (You can always refi again. The part that is irreversible is changing from public to private.

If you decide to refinance, this converts your government-backed loan into a private one. So, you’d lose certain protections like IDR and similar government programs. Check if the interest savings are greater than losing these payment plans.

This is more important than missing out on IDR or a similar repayment plan. Refinancing your loan will make you ineligible for federal protection programs like the Public Service Loan Forgiveness. Doctors and Dentists can use the PSLF program to serve in public and non-profit sectors to get their remaining balances forgiven.

Consolidation is often confused with refinancing. Consolidation allows you to take all your monthly payments with other lenders and combine them into a single payment. This strategy can also be used with other types of debt, such as credit card or medical debt.

The biggest difference between consolidating and refinancing is that refinancing mainly focuses on reducing the interest rate. Just like consolidating, refinancing your loans will also result in one monthly payment. Like refinancing, consolidating can be used to organize your debts in the same way. However, private loans are suitable for refinancing, while consolidation is meant for government-backed loans.

Having multiple loan payments to different lenders can get confusing. By consolidating, you can keep your financial house in order with one payment.

This loan is given to your parents, and it will be eligible for an ICR plan via consolidation. Without consolidating, it wouldn’t qualify for any income-based repayment arrangements.

A few disadvantages of consolidation are:

Refinancing can save you thousands with reduced interest rates. Consolidation can lower your monthly payment, but it won’t lower your rate. A longer term can cost you more money over time.

Consolidation can add one-eighth of 1% to the weighted average interest rate. The new rate is determined by a weighted average of all other rates and adds an additional 0.125%. Larger loans with higher rates will increase this weighted average, which will result in higher unnecessary interest costs.

This only applies if you consolidate federal and private loans. It’s important to separate your loans based on these statuses.

If you consolidate your PSLF loans, then you’d lose credit on your applicable payments. You must make 120 qualifying payments to be eligible for forgiveness under PSLF. So, be sure to exclude the loans that you’ve made PSLF qualifying payments on if you choose to consolidate them.

Your loan can be forgiven, and there are two main paths to do this: the public service loan forgiveness program and military service. Both come with sacrifices, but they can help you save on large student loan burdens.

You can be eligible for the Public Service Loan Forgiveness Program, or PSLF, if you work for the public sector or a non-profit for 10 years. You have to make at least 120 payments (they don’t have to be consecutive), and the government will forgive the rest of your balance. Yet, many students have heard misleading statistics that make it seem like it’s tough to become approved for forgiveness.

You can use the PSLF help tool to apply for the program, see if your employer is eligible, and navigate through the paperwork. Some examples of qualifying employers include the government, not-for-profit 501(c)(3) companies, and religious institutions. Unlike IDR plans, forgiven debt under the PSLF isn’t taxable. Consider this option before refinancing

There are many benefits of joining the military like being able to access VA loans, Tricare, a sense of pride serving your country, among others. But the military also has generous student loan repayment options. Working for the military will also qualify you for the PSLF program.

Options can vary among branches, but the Army has some helpful programs, including the Health Professions Student Loan Repayment Program. If you choose this program, you can receive $40,000 every year for up to 3 years. You must also be on active duty to be eligible. Luckily, most loans, including Perkins and private loans, qualify for this benefit.

Another lesser-known benefit that the military can help you with is deferment. Unlike forbearance, interest won’t accumulate if you’re on active duty and apply for deferment. You won’t have to worry about interest building up for 13 months after you return from active duty. Interest won’t rack up until you return to school with at least a half-time status.

Student loan debt, especially for medical and dental professionals, might seem insurmountable. Yet, you can use these student loan repayment strategies that will make it much easier to overcome these debts.

For example, refinancing your debt to save 1% in interest might not seem significant, but it can save you tens of thousands of dollars long-term. On the other hand, picking the wrong repayment strategy can cost you thousands of dollars.

Other student loan repayment options that require a bit more sacrifice, like public service or joining the military, can provide you with excellent benefits and forgive your debt so you can focus on other financial goals. A financial planner can help guide you through the student loan repayment process to ensure you pick the best repayment strategy for your big picture plan.

Will Koster, CFP®, is a financial advisor at Spaugh Dameron Tenny, where he helps high-net-worth professionals develop personalized, long-term financial strategies. Motivated by personal experience and a passion for meaningful planning, Will specializes in providing comprehensive financial guidance. He holds the CERTIFIED FINANCIAL PLANNER® and Certified Student Loan Professional® designations, along with Series 7 and 66 licenses. Committed to building lasting relationships, Will works closely with clients to align their finances with their values, enabling them to focus on what truly matters.

There’s no question that the economy is confusing right now. On the one hand, unemployment is low, earnings are up, and our homes are worth more than ...

Read More →As inflation has returned, the Federal Reserve has hiked interest rates four times from March 2022 through the end of July 2022. With interest rates ...

Read More →As you graduate from residency or fellowship and continue your career as a physician, addressing your student loan debt is an integral part of the ...

Read More →