While in training, the sooner you decide how to repay your student loans, the better. Because student loans will often be your biggest liability coming out of school, you will want to know what your repayment options are.

There are two general categories of student loans… Public and Private. However, there are a variety of differences when you dig deeper into public loans. At a high level, there is a distinction between the two main Federal loan programs. Federal Family Education Loans and Direct Loans come from two very distinct loan programs.

The Federal Family Education Loan Program (FFEL) was set up with private companies like Sallie Mae supplying the money for the loans (they were the lender) and the federal government guaranteed the loan on behalf of student borrowers. The program was around for 45 years, and only recently ended in 2010. One key fact about FFEL loans is that they are not eligible for Public Service Loan Forgiveness (PSLF) unless they are consolidated into a Direct Loan. However, consolidation can be very tricky. For example, if you consolidate your loans after you have already begun repaying them, you lose all your qualifying payments. You also forfeit any remaining grace period if you consolidate during that period.

Borrowers should pay close attention to FFEL loans because these loans have names similar to Direct Loans like PLUS, subsidized, unsubsidized, etc.

On the other hand, under the William B. Ford Direct Loan program, the funds come straight from the Federal Government via the Department of Education. This program has been around since 1993, but each school had to elect whether to participate in the program or not. Direct Loans have been the only source of public student loans since July 2010. These loans are eligible for the PSLF program.

With Direct student loans, you will likely have the following repayment options:

To determine your IDR payment amount, the US Federal poverty level based on your family size is subtracted from your salary, then the payment is set at a low percentage of your income that’s left over. There are a few different IDR options, and these have very distinct and important differences. The lowest monthly payment may not necessarily be your best option!

This is often where the most questions come up, and the most mistakes are made. The costs of those student loan repayment mistakes can add up.

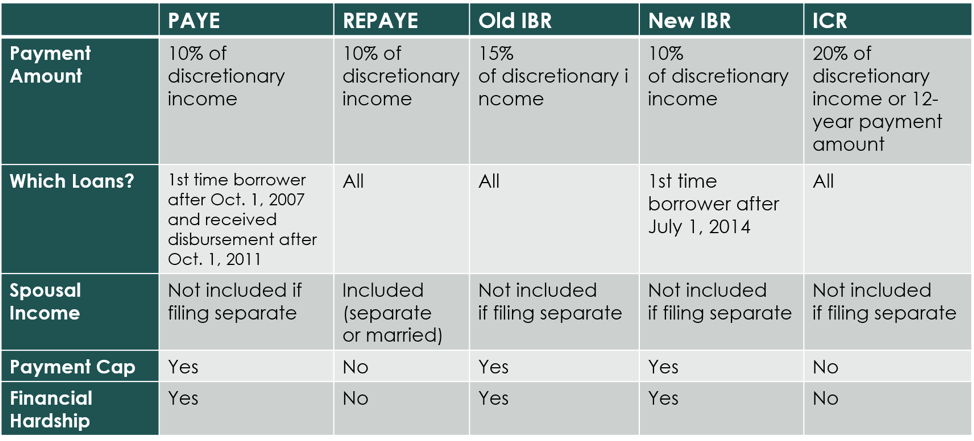

The chart below shows the income-driven repayment options that are available for PSLF qualifying payments.

Often borrowers stop paying attention after the first row, “Payment Amount”. This is what everyone cares about right? How much am I going to have to pay? In reality, all of the components of the IDR options matter when analyzing which plan is right for you.

The payment cap feature keeps your monthly payment from increasing to more than your original standard 10-year repayment amount. The payment cap does not apply to REPAYE and this is often where high income earners like physicians can get into trouble. For example, if your 10-year repayment amount was $2,500/month and your REPAYE amount is $3,500/month, depending on how far along you are toward 120 qualifying payments, you may end up paying off your loans within the time remaining!

Other important considerations include which loans qualify for which IDR plans, how spousal income is treated, and when you can switch repayment plans.

You’ll notice that PAYE and New IBR are limited to certain loans. The distinction here is not as simple as Direct versus FFEL loans. This qualification is based on when the loans were taken out and disbursed. This information can be found on the National Student Loan Data System.

The calculation between filing your taxes married joint versus separate, and how that will affect your monthly payment, has a lot of factors involved. If you opt to make IDR payments, and you are married to a working spouse, you might want to work with a CPA to understand whether filing separately makes sense.

The financial hardship calculation is important when you are qualifying for a repayment plan or looking to switch repayment plans. PAYE and IBR (Income-Based Repayment) require you to have a financial hardship to qualify. The financial hardship is based on your debt to income ratio and your standard 10-year repayment amount. As your income increases, it may become harder to qualify for certain IDR plans or switch your IDR plan.

When it comes to medicine, it takes a trained professional to answer complicated questions and base recommendations on the patient’s individual circumstances. Why wouldn’t the same apply to your student loans? One size does not fit all. That’s why you should consult an expert to help avoid mistakes, eliminate headaches, and feel confident in your student loan game plan.

Will Koster, CFP®, is a financial advisor at Spaugh Dameron Tenny, where he helps high-net-worth professionals develop personalized, long-term financial strategies. Motivated by personal experience and a passion for meaningful planning, Will specializes in providing comprehensive financial guidance. He holds the CERTIFIED FINANCIAL PLANNER® and Certified Student Loan Professional® designations, along with Series 7 and 66 licenses. Committed to building lasting relationships, Will works closely with clients to align their finances with their values, enabling them to focus on what truly matters.

As you graduate from residency or fellowship and continue your career as a physician, addressing your student loan debt is an integral part of the ...

Read More →Do you feel anxious about your student loans? You’re not alone. Did you know that borrowers in the United States hold a collective $1.6 trillion in ...

Read More →