Transition planning involves preparing for the financial and lifestyle changes that take place as you transition from training to practice. This is a period when a lot of new decisions need to be made.

As mentioned in part one of this segment, all financial considerations for a physician’s transition to practice require cash.

How much should you save for your transition period? Based on our experience, we’ve worked with physicians who need anywhere from $5,000 - $40,000.

Here’s a breakdown of potential scenarios at the lower and upper ends:

Typical Transition Period Scenario:

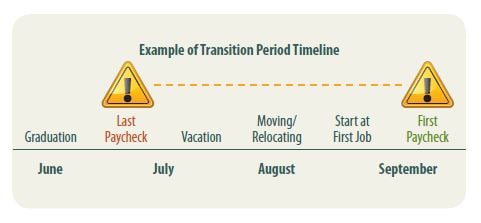

Congratulations! You have just taken a job at a private practice in Charleston. Your new position starts on August 1. You finish training on June 20 and have enough savings to stay afloat for the end of June and the month of July. Unfortunately, your new practice pays monthly, so you won’t receive your first paycheck until September 1. Now you are left using your credit card or borrowing money from your family until you get paid, even though you’ve already begun working. The earlier you can start planning for your transition period, the less negative impact it will have on your financial health.

The unpaid time between training and practice is probably the one area of planning that catches most residents and fellows off guard.

We advise you to prepare for your transition by setting a realistic budget for this transitional period and beginning to save as soon as possible. With savings in hand and perhaps an emergency fund in place as well, you’ll be prepared to tackle this time without digging a massive financial hole.

If you’re unsure of where to start, our advisors are more than happy to help you plan for a successful transition. Connect with us to schedule an introductory call to discuss your financial health.

Cover/Thumbnail photo from Op-Med | CRN202006-232311

John Dameron has been a financial planner and partner with Spaugh Dameron Tenny since 2002. With the help of the SDT team, John created a lecture series called Physicians Financial Focus, authored a book entitled The Residents and Fellows Financial Survival Guide, and has coached hundreds of physicians from residency/fellowship into practice. His expertise has also been featured on KevinMD.

Whether you're launching your career, navigating a major life change, or preparing for retirement, it's never too early or too late to benefit from ...

Read More →This year, April 15th is the deadline to file your 2024 tax return, and it is quickly approaching. Whether you work with a CPA or another trusted tax ...

Read More →For those with significant financial success, a bonus represents more than just extra income. It’s a chance to create meaningful progress toward your ...

Read More →