Physicians have some unique challenges when it comes to planning for retirement. Because of the amount of time they spend in medical school, their careers start a few years later than their peers, and often the priority is repaying education-related debt.

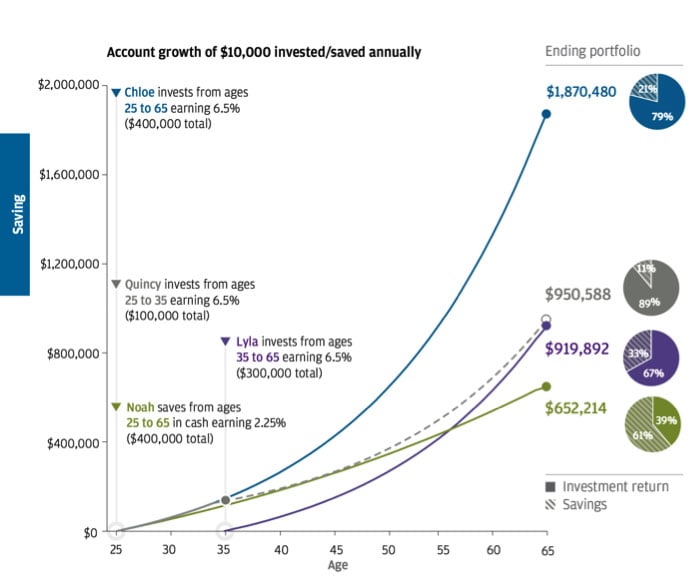

However, it’s critical to start putting money into a retirement account as early as possible. Thanks to compounding interest, a few dollars invested early in a career can make a big difference in the size of the nest egg at retirement. The Benefit of Investing Early chart below shows investing consistently at an early age allows Chloe to accumulate more wealth than Lyla who decided to start investing ten years later.

Source: J.P. Morgan Guide to Retirement 2017 Edition

Whether physicians are early or late in their careers, it’s important to start setting aside retirement savings. It could be as simple as contributing to an employer’s 401(k) or 403(b) plan, which allow tax-deferred contributions and often include employer matching. Standard IRAs and Roth IRAs are two more options for making tax-deferred retirement contributions. When possible, contribute the maximum allowable amounts, but again, saving something is far better than saving nothing at all.

Even physicians who are self-employed may be eligible to open individual, self-directed 401(k) plans, often called solo 401(k)s, in which they can contribute to retirement savings. Self-employed physicians who have a need and ability for higher tax reduction savings, can also consult a financial professional for guidance around pension like plans for small business owners.

Of course, signing up to contribute to a retirement account is just the first step. Depending, on the plan, physicians who are planning for retirement will also need to determine the appropriate investment strategy. Retirement plans often facilitate a variety or financial products, ranging from low-volatility government securities to higher volatility stocks. Risk tolerance should be carefully considered along with retirement goals and your time horizon.

As you consider the complexity of planning for financial independence, you may find it helpful to hire a Certified Financial Planner Professional. They are knowledgeable about investment accounts and can help you with a variety of financial topics, including the 6 Money Decisions.

If you would like help with securing a solid financial future for you and your family, contact SDT Planning today.

Donor Beware: 3 Important Ideas for Charitable Giving

Organizing Your Financial Junk Drawer

6 Money Decisions for Physicians and Dentists

CRN202011-239153

Shane Tenny is the managing partner of Spaugh Dameron Tenny. Along with hosting the Prosperous Doc® podcast, Shane has a true passion for behavioral finance, helping clients and audiences understand how to develop successful strategies based on their unique temperaments. An accomplished and highly engaging speaker, Shane is regularly interviewed for television and podcasts, is actively involved in the Financial Planning Association®, and contributes to industry advisory boards.

Whether you're launching your career, navigating a major life change, or preparing for retirement, it's never too early or too late to benefit from ...

Read More →Making the decision to buy into a surgery center is a significant financial and career move for any physician. While it can be a profitable ...

Read More →This year, April 15th is the deadline to file your 2024 tax return, and it is quickly approaching. Whether you work with a CPA or another trusted tax ...

Read More →