Financial planning means different things to different people. To some it may simply mean investments; to others, insurance; to others, a Swiss bank account and a private jet. We believe that, at its roots, financial planning is simply making smart decisions about your money with your goals in mind. We’ve broken it down into six money decisions you need to make about your finances that will apply throughout your financial life.

As a resident or fellow, this is an easy decision – one that’s already been made for you. You are an employee of the hospital and as such you earn a paycheck and receive a W-2 at the end of the year. Later on, you might earn income outside of your primary job or practice by speaking, endorsing, moonlighting, or consulting. How will you accept this additional income? As a sole proprietor? As an individual? As a corporation?

These decisions involve how much you spend on a typical month-to-month basis. What’s important to spend money on? What’s not important? What are your fixed expenses (mortgage, utilities, health insurance, etc.)? What are your variable expenses (clothing, dining out, charitable giving, etc.)?

How much do you put into your Emergency Fund? When should you start saving? How conservative or aggressive are you with your saving habits? Should you put money into your retirement plan or save it elsewhere? Does it make sense to save first, and then pay off debt, or a combination?

Borrowing money is a task that many individuals have participated in and will need to make decisions about. Will you pay back your student loans quickly or over a prolonged period? What sort of repayment plan will you sign up for? If you have cash on hand to pay for a car, should you borrow money to pay for the car or use all your cash? What type of mortgage makes the most sense for you, and are physician-specific mortgage programs an attractive option?

There are two types of giving: voluntary giving – church, charity, children; and involuntary giving – taxes and fees. How can you maximize one while minimizing the other? Speaking with a financial planner that specializes in white coat finances can help you understand how to decide to prioritize these payments.

What will happen to you, your family, and your lifestyle in the case of an accident, sickness, death, or lawsuit? How will you prepare for the unforeseeable? Financial planning involves looking at all of the above decisions and their

impact on each other – both positively and negatively. The decisions you make in one area of your finances can affect all the other areas of your financial situation – they are all interconnected. Financial planning isn’t simply setting up an IRA, having your taxes done, or buying insurance. These are all important financial decisions, but individually they do not create a financial plan.

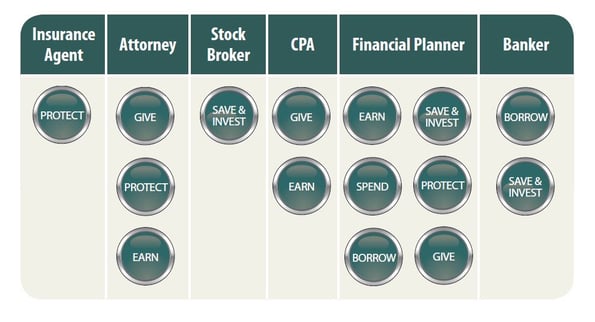

Not every financial professional is a financial planner. Do you know the difference?

Although there are only six decisions to make about your finances, this can still be a daunting task. Thankfully there are financial professionals who are able to help equip you to make the best decisions for your scenario. To the right is an example of the types of financial professionals who would be able to help you, as well as their areas of expertise.

CRN202202-260583

John Dameron has been a financial planner and partner with Spaugh Dameron Tenny since 2002. With the help of the SDT team, John created a lecture series called Physicians Financial Focus, authored a book entitled The Residents and Fellows Financial Survival Guide, and has coached hundreds of physicians from residency/fellowship into practice. His expertise has also been featured on KevinMD.

Investing in a surgery center can be an intriguing opportunity for young physicians, but it's crucial to ask some essential questions first. When ...

Read More →In the United States, socioeconomic disparities have long been a pressing issue, with certain communities facing significant economic challenges. In ...

Read More →Finance has a reputation for being complicated and confusing. And like many industries, finance has its own vocabulary, acronyms, strategies, and ...

Read More →