The benefits of charitable giving extend beyond helping others. Consider making charitable contributions as 2023 comes to a close and discover ways to reduce your year-end tax exposure.

There are multiple ways to donate to a charity. Donations can be made from cash accounts, appreciated assets (stocks or mutual funds), real estate property, or tangible goods such as old vehicles or even clothing.

The Giving USA 2023 report reveals total giving to U.S. charities in 2022 reached an estimated $499.33 billion. However, this figure represents a decrease of 3.4% in current dollars compared to the previous year, with a more significant decline of 10.5% after adjusting for inflation.

With giving being down, there is no better time to determine the most efficient manner to make these contributions for you and your family.

There may be a more advantageous strategy than donating cash.

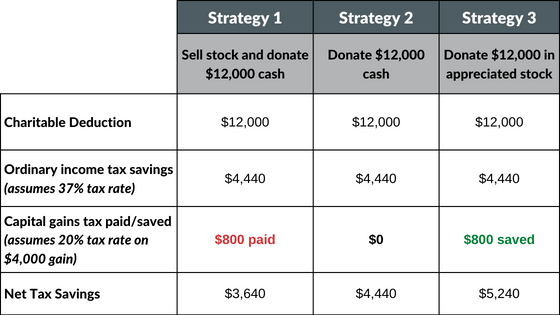

For example, if you own appreciated stocks or mutual funds, consider donating the appreciated assets from your portfolio rather than cash from your bank account. The tax deduction for appreciated stocks or mutual funds is equal to the market value of the asset upon the donation (if the asset is owned for more than 12 months).

This allows you to:

The table below compares three charitable giving scenarios:

The simple answer is no. Cash is better than donating a stock or mutual fund that is down in value.

If the stock is valued less than your original purchase price, you are better off selling the stock and contributing the proceeds of the transaction to charity. In fact, you may receive tax benefits when it is time to file.

The tax benefits come from receiving the itemized deduction for your charitable contribution as well as a capital loss on the sale of stock.

A charitable giving strategy that more and more individuals are starting to utilize is the use of a Donor-Advised Fund. A Donor-Advised Fund is a charitable giving vehicle that offers flexibility for individuals participating in annual philanthropic giving.

Donations to the fund are irrevocable but are eligible for a tax deduction on the date they are received by the fund. Therefore, allowing you to “time-shift,” that is, to donate now, receive the tax deduction now, and make grants in the time frame that works best for you.

In addition, the Donor-Advised Fund can be used to make contributions to multiple charities, establish automatic contributions, and even grow the value of your future charitable gifts.

If you haven’t determined your end-of-year charitable giving plan, now is an excellent time to figure it out to ensure you receive credit for your donation in 2023.

Find a charity that means something to you and make an impact. Remember, when you decide to support a non-profit organization or charity, you are not only helping them. To know that you are helping others is hugely empowering and, in turn, can make you feel happier and more fulfilled.

Research has identified a link between financially supporting a charity and increased activity in the area of the brain that registers pleasure — proving that, as the old adage goes, it really is far better to give than to receive.

If you have questions about year-end charitable giving, please get in touch with one of our financial planners to discuss what options and strategies best suit your situation.

###

The information provided is not written or intended as specific tax or legal advice. We are not authorized to give tax or legal advice. Individuals are encouraged to seek advice from their own tax or legal counsel. Individuals involved in the estate planning process should work with an estate planning team, including their own personal legal or tax counsel.

CRN202510-3280057

Jordan Bilodeau, CFP®, CEPA, is the Director of Planning & Strategy at Spaugh Dameron Tenny, where he leads firmwide planning initiatives and helps clients navigate complex financial decisions. With experience in portfolio design, tax strategies, and business succession planning, Jordan works with executives, physicians, dentists, and successful retirees to coordinate every aspect of their financial lives. He holds both the CERTIFIED FINANCIAL PLANNER® and Certified Exit Planning Advisor designations and has a Master’s degree in Wealth and Trust Management, providing tailored guidance for clients.

Each year, our team of financial advisors receives a steady flow of questions about the best ways to approach charitable giving during the last ...

Read More →Have you ever considered the benefits of gifting appreciated assets?

Read More →Although April often gets the most attention for tax filing, the final months of the year are crucial for high-income and high-net-worth individuals ...

Read More →