Student debt, especially for doctors and dentists, might seem intimidating. As you begin training or enter into practice, large debt can feel like a huge weight on your shoulders. Having limited time to think about strategy can leave you feeling stressed out.

If you're thinking about applying for public service loan forgiveness (PSLF), your goal may be to pay the least amount possible. This will ensure a higher forgiven balance. Some strategies like negotiating with an employer are straightforward, but overlooked. Other debt pay off strategies like taking advantage of the CARES act provisions are relatively new but still effective.

One of the most important big picture items to consider is your emergency fund. Ideally, you should have 3-6 months of net living expenses in a high-interest savings account. This will keep you afloat during unemployment and will help you tackle unexpected expenses like car repairs.

With an emergency fund, you might be able to have a higher monthly payment to pay off student loans quicker. Not so fast.

You should always consider your emergency fund when budgeting, refinancing, or planning for other financial goals. Not having this extra cash could leave you vulnerable during tough times. It might not let you achieve the financial goals you’ve been working towards.

If your income increases, consider allocating these extra funds toward your loans. When times get tough, you can choose not to make these extra payments.

Be sure that your emergency fund covers net survival expenses like rent/mortgage, food, clothing, health insurance/medical expenses, and your student loan payment. You can inquire about forbearance with your lender during tough times. However, you need to keep in mind that interest accrues during this period. This will cost you more over the long run.

Besides an emergency fund, there are other financial goals that you might want to consider. Some of these include saving for retirement or placing a down payment on a home. If you earn an additional bonus or income; while it may be tempting, refrain from putting it all towards your student loan payments.

Instead, allocate appropriate amounts towards these other goals. This might seem tough, but some tips for saving for multiple goals include:

Breaking down your goals into manageable chunks will keep you on track to reach your long-term and short-term goals. Saving for retirement is a long-term goal while a common short-term goal could be saving for an auto loan down payment.

To plan for your financial goals, you have to weigh out your needs versus wants. Do you need a $30,000 car, when a $7,000 one would be sufficient? Do you need to go on a tropical beach vacation or could you use that money to help pay off your student loans?

Automating cash flow helps lift the burden of manually having to deal with bills and other transactions. You can automate student loan payments, retirement account, and savings contributions, which can help you accomplish financial goals without having to think about them.

Be sure to re-evaluate your student loans/financial strategy when necessary. Make any corrections if needed and don’t feel bad if you come short occasionally.

Having low debts can also help you with various financial goals including saving up for a downpayment on a home. A dilemma doctors often face is deciding to take a lump sum of cash and paying down (or off) student loans versus investing. There is not a one size fits all answer to this. It really depends on cash flow and other upcoming goals. For example: if you are planning for home renovations or want to build a house, it might make sense to hold onto cash because you will need it for a construction loan down payment.

If you have excess cash every month, you may want to consider using some of your excess cash to pay off your student loans. Once your student loans are paid off, instead of splurging, you can shift that extra cash to automated savings and invest each month. The last thing you want to do is to forget to record the excess cash and to let it wash down the spending stream when your debt is paid off.

According to CommonBond, an innovative student loan lending and education company, “If you’re saving up for a house down payment, lowering your student loan bill can help you decrease your debt-to-income ratio (DTI), which is an important factor if you plan on applying for a mortgage.”

DTI ratios can make it easier for you to obtain various types of tailored financing at affordable rates. It shows lenders that you’re responsible and can be trusted with credit which will let you pay off student loans faster.

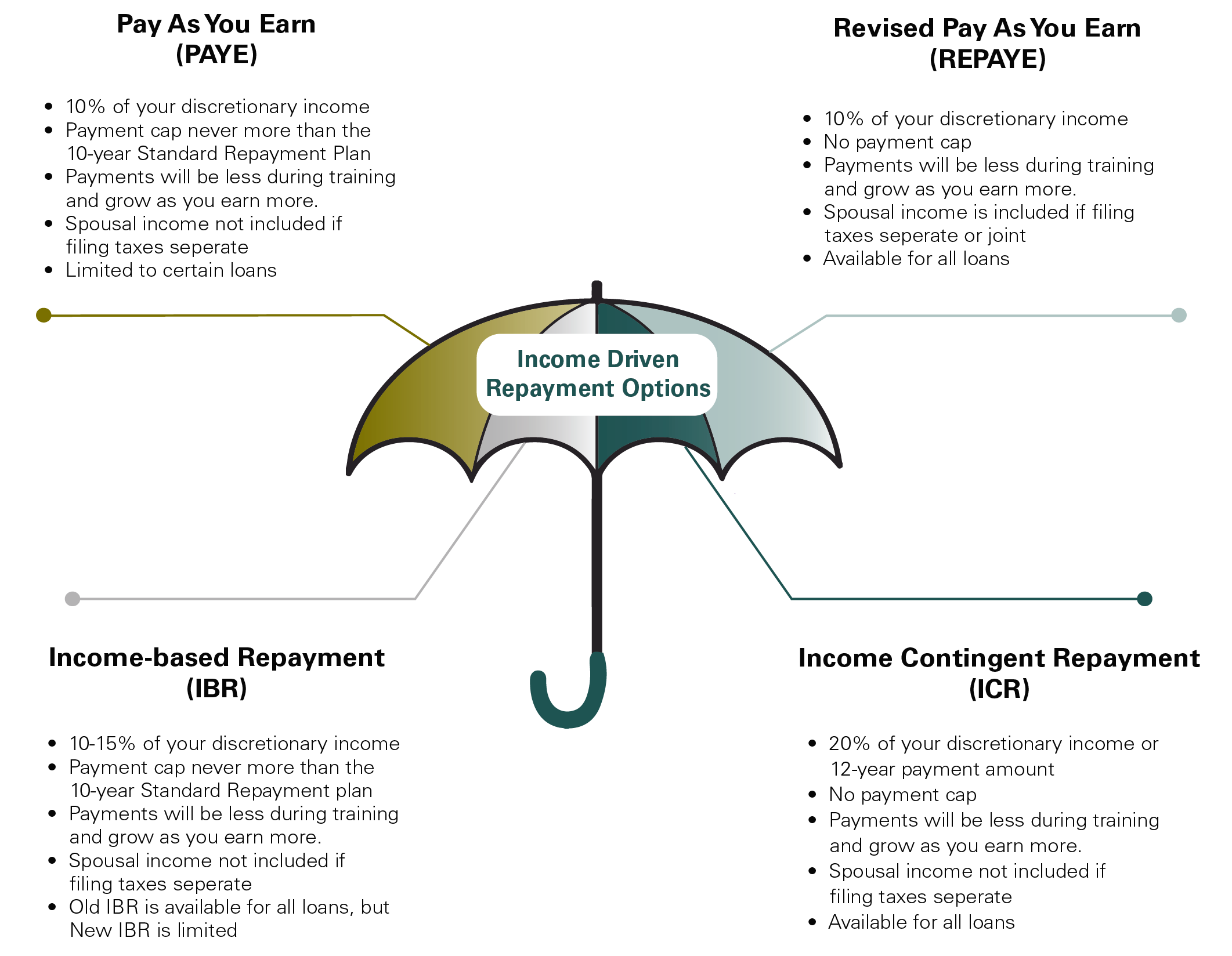

If you're, if you are going on for public service loan forgiveness, then typically your goal is to pay the least amount possible and have the rest forgiven when you become eligible. Income-Driven Repayment plans cap your monthly payment at a certain percentage of your monthly income (usually around 10-20%). This will make your loan payments more manageable for its term, which ranges around 20 years depending on the option you choose. The main IDR options include IBR, PAYE, REPAYE, and ICR.

Your student loans will be forgiven after the term, but this forgiven balance will likely be considered taxable income. This tax liability might seem daunting, which is why you should consider applying for Public Service Loan Forgiveness or PSLF.

This program is similar to IDR options as your balance will be forgiven after a certain period of time or 120 payments (that don’t have to be consecutive). To qualify for PSLF, you must work for an eligible employer which includes the government, not-for-profit 501(c)(3) companies, and religious institutions.

Using this custom student loan repayment questionnaire will help you determine if your employer is eligible for PSLF. With this questionnaire, you will understand what paperwork you’d need along with other requirements.

PSLF is one, if not the most effective way to pay off student loans faster without high tax liabilities.

Some common PSLF mistakes include:

If you consolidate loans that you’ve made qualifying PSLF payments on, then you’d lose all progress towards forgiveness.

Unfortunately, one of our clients, an emergency medical doctor, lost PSLF eligibility after consolidating his loans, despite making timely payments.

If you are not eligible for PSLF, how else can you minimize your debt to pay it off faster? First a foremost, it is prudent for your student loan repayment strategy to provide flexibility to your cash flow and goals, but there are still opportunities you can take advantage of to reduce the amount of interest which you pay

Before COVID-19 swept across the globe, cash-out refinancing on your mortgage was a strategy to reduce your interest. Unfortunately, banks have tightened up and cash-out refinancing is not as attractive as it was before.

On the bright side, there are four reliable ways to reduce the interest on your student loans:

Refinancing replaces your loan with a new one at a lower rate. You can choose from a variety of lenders that have different offerings. It can also organize your finances since you’ll have just one student loan monthly payment.

Paying off high-interest debt first will save you money over the long run. Tackling debts with higher rates will let you apply these funds to the principals of lower rate debts. This strategy is referred to as “the debt reversal pyramid.”

It might be harder on your budget, but higher monthly payments will get rid of your debt quicker. The sooner you pay off debt, the less you’ll pay in interest. Use this amortization calculator to see the breakdown between interest vs. principal payments.

You can set up automatic payments so that money will be automatically applied to your student loan payment each month. Not only is this convenient, but it can save you money. Most lenders including the Department of Education offer a 0.25% rate discount if you set up auto payments.

It might seem surprising but your employer wants you to pay off student loans quickly too. Many employers like hospitals and other healthcare companies are offering very attractive student loan repayment benefits to doctors. For example, one of our clients gets $25,000 per year paid directly to his lender for 5 years.

Terms can vary based on employer, with some like Banner Health, a non-profit system, offering physicians that practice in a rural area $100,000 towards their student debt.

You’d receive this amount provided that you’ve worked for Banner Health for 5 years. If you leave after year one, then you’d only receive $20,000.

Keep in mind that the IRS considers employer loan payments to be taxable income with the exception of $5,250 due to the CARES act. You might have to pay higher taxes and consult your tax professional for further questions.

COVID-19 has caused high unemployment, devastated retirement accounts, and has caused financial uncertainty.

It also prompted the government to pass the CARES act to help Americans properly manage this crisis. This act offers many benefits like paused RMDs, flexible retirement plan distributions, business funding, protection against eviction, and student loan relief.

Currently, all payments on federal loans including FEEL, Perkins, HEAL and direct have been suspended until September 30, 2020. Fortunately, interest won’t accrue during this time. Private loans and those backed by universities like some types of Perkin loans aren’t eligible for these benefits.

These provisions are helpful if you’re struggling to pay your bills. If you have more disposable income, consider using these amounts to make extra payments. Even a few extra payments during this time will let you pay off student loans faster.

Making small payments might not seem like much, but compounding interest can add up over the long term. If you’ve paid all the interest on your loan that has accrued before March 13, 2020, then your payment will be applied to the principal. Some other powerful benefits of these suspended payments are that they count towards forgiveness under the PSLF and IDR (Income Driven Plan) repayment plans.

The worst thing that you can do is nothing and avoid decision making. If you want to be successful with finances and life; you must take action. Even small steps are more effective than procrastination.

Don’t be afraid of asking for help as you’d be surprised by how accommodating creditors and employers can be. If you have a positive payment/work history and are easy to communicate with, then most lenders, employers, and other influential parties will want to help you pay off student loans faster!

It might seem daunting when you have to pay $500+ each month for years in order to service your student debt. Luckily, you can establish the proper plan and systems to pay off student loans faster.

You can take advantage of new laws like the CARES act, PSLF, and negotiate with your employer for student debt assistance.

CRN202207-26785

Partner and Financial Planning at Spaugh Dameron Tenny.

Over the past several weeks, major developments have affected the federal student loan landscape. For the first time in over three years, payments ...

Read More →There’s no question that the economy is confusing right now. On the one hand, unemployment is low, earnings are up, and our homes are worth more than ...

Read More →Have you worked at a not-for-profit or governmental organization for at least 10 years of your career? Do you still have student loans? Do you know ...

Read More →