The word ‘investing’ can seem overwhelming; the terminology, the different strategies and, of course, the actual investment selection. But the truth of the matter is that ‘investing’ itself is not as scary as it sounds. In fact, if you have funds set aside in a savings account or you have been contributing to your retirement account then you are already taking steps in the right direction! But will that money create financial freedom for you and your family down the road?

As advisors to medical professionals, we encourage our clients to look beyond the scope of basic savings when planning for their financial success. The three essential considerations when determining suitable investment options are: understanding your goals, having a time horizon and recognizing your tolerance for risk. While it’s important to first establish an emergency fund and make maximum contributions to your retirement plan, the next crucial step is to have your money work for you – and this is where investing comes in.

As we talk about savings and investment strategies today, we will be highlighting examples taken from a case study, from the framework of a real physician, involving two of our friends: Dr. Sarah and Caleb Smith.

We will be covering the benefits of investing, the importance of setting your goals, assessing risks and determining when you should invest. Along the way, we will provide explanations for how money is managed and offer investment strategy ideas for you to consider. Let’s get started.

One of the first steps in successful investing is defining why it’s important to you – what are your goals? The theory behind goal-based investing is that by setting goals you’ll be more likely to save for (and attain) those goals. Whether it be saving for a new car or thinking further out towards retirement, it’s important to highlight what this money will be used for and when it will be used.

Once you have determined your goals, you can start planning. During the planning process, you will want to uncover both the total cost of the investment and your initial funding amount, as well as how much you’ll be able to contribute over time. Knowing these key factors ahead of time can increase the likelihood of achieving your goals.

When choosing your investments, it is important to evaluate your sensitivity to risk. A simple way to do this is by asking yourself what you would do in the situation of a market correction. If your answer is to take your money and run, then chances are you are more risk-averse and you may want to consider more conservative options. As the saying goes, higher risk is associated with the possibility for higher returns – but of course, this can also mean the potential for greater loss.

Outlining your goals and a time frame will better help you determine a comfortable level of risk. If your goal is more short-term, you may not be willing to take on the same amount of risk as someone who has a longer time horizon. It’s important to understand that aggressive and conservative investment vehicles serve two different purposes: respectively, to seek higher returns and to preserve capital.

Another factor to consider when choosing your investments is when. When is the right time to invest?

You will not be ready to invest until . . .

Once you have checked all of these boxes, you can then get started with pursuing investment options that will help you achieve your goals.

You need to understand how money is managed and how a mutual fund works. This knowledge is key to helping you make educated investment decisions.

How a Mutual Fund Works

Mutual funds can invest in a whole bunch of things, not just stocks. A mutual fund is nothing more than a group of people, pooling their money together and working with an investment company who is going to find a portfolio manager, (a mutual fund manager) whose job is to take all of the money and decide how it is going to be invested. It’s up to his or her discretion to decide whether he’s going to buy AT&T, or Wal-Mart, or Microsoft, whether they want to buy CDs, or real estate, a whole host of opportunities … bonds, stocks, real estate, etc.

First, Define the Objective of the Fund

What governs and guides the manager is based on the objective of the fund.

One of the interesting things, as we work with clients, is when they say ‘I don’t think I have a good portfolio’, it’s not uncommon for the fund itself to be perfectly fine, it’s just that the objective of the investor doesn’t match the objective of the fund.

There are three advantages to investing in mutual funds: diversification, professional management, and money growth.

Once you understand how money is managed, then you will need to understand how you should invest. There are two primary strategies you can use to mitigate the fluctuations within the stock market, the buy and hold investment strategy, and the dollar cost averaging investment strategy.

Buy and Hold Investment Strategy

The first is called buy and hold. Over time, the market has a history of moving in an upward direction. However, there are also times when the market goes down. Simply put, when employing a buy and hold strategy you invest a sum of money and hope and trust that when you need the money back, the market will have gone through its gyrations, will be higher than when you originally started investing, and that your principal will be worth more than when you invested it. The longer you hold, the more likely it is that the account may have appreciated.

Dollar-Cost Averaging Investment Strategy

The second strategy you could employ is called dollar-cost averaging. It’s a system of subsequent periodic purchases that allow an investor to manage their risk.

There are fees and charges associated with investing in mutual funds. Mutual funds are subject to market risk, including the potential loss of principal.

Now that we have a general understanding of goal setting, assessing risks, best times to invest, how money is managed, and an overview of a couple of investment strategies, we can take a closer look at this case study which involves Dr. Sarah and Caleb Smith. Take a look at this snapshot of their financial picture.

Dr. Sarah and Caleb Smith Financial Snapshot

Assets

Liabilities

They have many of the same questions you do about how much to have in savings, whether to pay off debt, Roth IRAs and when and where to invest?

Now I think we’d agree that Sarah and Caleb can answer yes to each of the “when should invest” questions, so it seems reasonable for them to consider investing. Obviously, this may not be true in your situation and that’s OK. We’ve created their scenario specifically to allow us to discuss some of the other investment questions you raised, but if you would answer “no” to any of these questions, then it really makes most sense to work on those issues first.

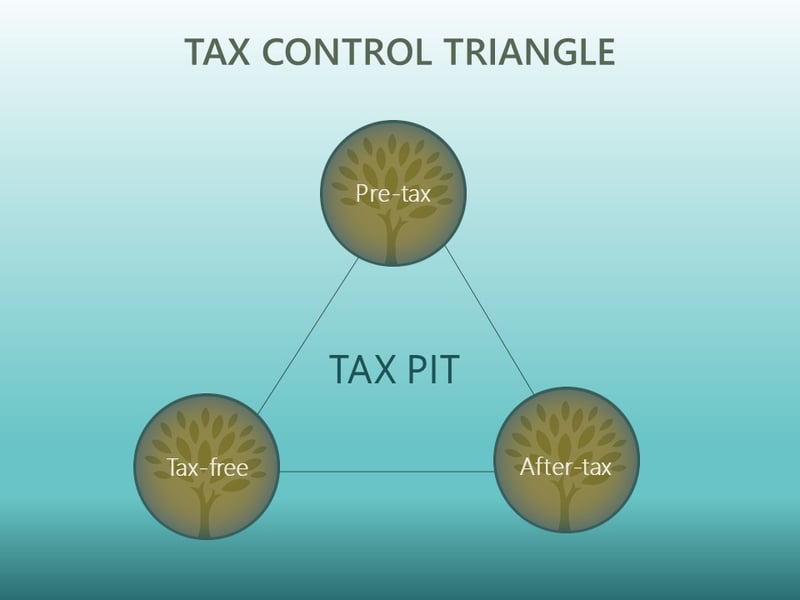

But, since Sarah and Caleb can start investing $400/month, we need to understand how to choose where they should start. To do that we’ll introduce the TAX CONTROL TRIANGLE.

It’s helpful to begin a review of investment options while understanding their tax implications, so here we’re going to introduce you to a concept we call the tax control triangle.

Pre-tax

The first category of investment vehicles is considered pre-tax because contributions are made on a tax-deductible basis or before your paycheck is deposited. [ask for examples: 401k, 403b, Keough plans, IRAs, SEP IRAs, etc.]

After-tax

Over here, we have “after-tax” investment vehicles, such as savings accounts, money market accts, mutual funds, CDs, and brokerage accounts with stocks and bonds.

After-tax/Tax-free Hybrid

Now, this final category uses after-tax contributions but the proceeds are ultimately tax-free. Can anyone think of something that might fall into this category? Yes: Roth IRAs, College savings plans/529s, the cash value in a life insurance policy, and home equity in a primary residence. Money that you invest here is after-tax, but after you put in the initial deposit, any dividends, interest, or appreciation, happens without any tax liability – and 100% of the proceeds come back to you!

So let’s go back to Dr. Sarah and Caleb. The point here is not that all your money should be in one bucket or the other, which is sometimes a hasty conclusion, but that there are benefits to each category, and it’s helpful to understand these so that you can make an informed decision for Dr. Sarah on where to put her $500 a month.

Since Sarah is already putting money into a 401k and receiving the maximum matching dollars, and they have enough of an emergency fund to get through their transition, then the other avenue that’s really attractive right now is up here in this bucket, and that’s a Roth IRA. Now I know that a couple of you had questions about the Roth IRA, so let’s take a moment and talk about those…

Traditional IRA vs. Roth IRA

So the difference between a traditional IRA and a Roth IRA is that the money we put in a traditional IRA is deductible today, but in the future will be fully taxable. Whereas money that we put in a Roth IRA is after-tax today, but no matter how big it grows in the future, it’s tax-free. That sounds pretty good, doesn’t it? In fact, it sounds so good that the IRS wants to severely limit who can put money into Roth IRAs. So, for most physicians, you may not be eligible to put money in Roth IRAs when you are in full practice, because you may be earning too much and exceed the income limits on contributions.

Dollar-cost averaging does not inherently make you double your money, but it is important to be intentional about how you invest. Dollar-cost averaging helps you to reduce the risk because you end up with more shares at cheaper prices, and fewer shares at the more expensive prices, so even a small rise in the value of the stock helps increase return.

Specializing in the financial planning needs of medical professionals, our goal at Spaugh Dameron Tenny is to help you make smart financial decisions that will ultimately help you achieve your goals. We firmly believe in the value our in-depth services can provide, as annual financial planning allows you the opportunity to formally review your goals, make any updates (if needed) and evaluate your progress along the way. Whether you are in residency, practice or retirement, we invite you to explore our services. Contact us today at (704)-557-9750 to learn more about how we can help you.

Get the 5 Steps to Organize Your Finances Checklist:

Editor’s Note: This post was originally published in December 2018 and has been completely revamped and updated for accuracy and comprehensiveness.

CRN202004-229129

Shane Tenny is the managing partner of Spaugh Dameron Tenny. Along with hosting the Prosperous Doc® podcast, Shane has a true passion for behavioral finance, helping clients and audiences understand how to develop successful strategies based on their unique temperaments. An accomplished and highly engaging speaker, Shane is regularly interviewed for television and podcasts, is actively involved in the Financial Planning Association®, and contributes to industry advisory boards.

Investing in a surgery center can be an intriguing opportunity for young physicians, but it's crucial to ask some essential questions first. When ...

Read More →In the United States, socioeconomic disparities have long been a pressing issue, with certain communities facing significant economic challenges. In ...

Read More →When the market isn't doing what it used to, at least in recent memory, it may feel tempting to abandon ship or question your approach. Has this ever ...

Read More →