When the market isn't doing what it used to, at least in recent memory, it may feel tempting to abandon ship or question your approach.

Has this ever happened to you? You're driving to work on a two-lane highway when traffic in your lane starts to slow down. There are brake lights are far as the eye can see. You look over your shoulder and switch to the other lane to try and make up some time. But in about 3 seconds, the traffic in your current lane slows down, and the lane you were in starts to move again.

You begin to second guess yourself and wonder if you should've switched lanes at all...

Does this response sound familiar to you? Do you ever look at your portfolio in the midst of market volatility and start to have the same reaction?

You start to think: "Maybe the thing that I'm in is the wrong thing and I need to be in something else." Maybe you even start making changes only to realize the original portfolio was the right fit after all.

Watch this video or continue reading this blog to learn more about the rewards of patient, long-term investing.

When we look at the long-term market returns, we know that it has significant compounding ability.

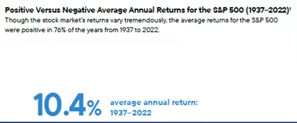

And if we look at the last 85 years of the market — from 1937 through the end of last year, which was a bear market — we can see that the average annual returns of the S&P 500 have been over 10%.

Of course, this didn't happen each and every year, but that is the long-term average. The result is a market that is up 75% of the time. Three out of every four years are positive, and historically, one out of every four years is a down year.

When we take these things together, we realize that the combination of brake lights and gas pedal results in good long-term growth for the S&P 500.

Now, this doesn't come linearly, and the market is down a quarter of the time.

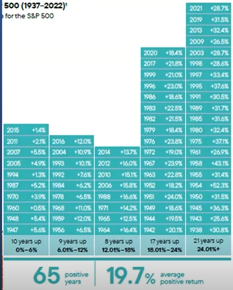

21 out of 85 years, the market closed in negative territory for the calendar year. Five times it was down less than 6%. In 2008, the market was down over a third, and yet it represented only three times in the last 85 years that the market was down more than 24%. On average, the down years have been down about twelve and a half percent, with 2022 being down 18%.

But 75% of the time the market closes positive.

While there are only three years where the market has closed down more than 24%, there are 21 years where the market has closed up more than 24%. Look at the stack of positive returns below. In 65 out of 85 years, the market has closed positive, resulting in an average positive return of nearly 20%.

Now, here's an interesting thing to note. If you look in the second column, you'll notice there are only two calendar years, 1993 and 2004, where the S&P's return was actually close to its long-term average of 10%. This means in all other return periods, the market was up or down more or less than its long-term average.

So, don't expect the S&P to give you a 10% return this year, next year, or the one after that. It just isn't likely.

But when we look at these things together, we see the result of long-term patience. Long-term returns of over 10% in the S&P 500 for the last 85 years.

Let's focus on the last 20 or so years. Between 2003 and the end of last year, we've had 17 positive years, with only three of them ending down. Think back to the year of COVID ... the market was down 34% in the second quarter but ended the year up 18.4%.

It's helpful to keep it in perspective. This timeframe represents 5035 trading days. 5035 days that the stock market was open. And it takes the right temperament, strategy, and perspective to stay in there and get long-term returns. Because if you miss just ten days, it significantly reduces your long-term return.

Hopefully, this reminder of historical truth helps you as you find ways to combat the sensational headlines that barrage us every day. If you have questions about your portfolio or the strategy you are taking toward your goals, don't hesitate to reach out to our team.

Thank you to our friends over at Franklin Templeton Investments for the graphics used in this blog and video.

CRN202604-4208194

Shane Tenny, CFP®, is the Managing Partner of Spaugh Dameron Tenny and a nationally recognized financial advisor. Since 2000, he has combined extensive financial knowledge with a passion for behavioral finance—helping clients make informed decisions based on both data and mindset. Shane often contributes to industry publications, appears as a guest on podcasts, and has been a leader in the financial planning field for years. He is known for making complex topics clear and practical for busy, high-income professionals seeking personalized advice they can trust.

Many investors consider rental real estate and diversified portfolios as potential sources of passive income, but each comes with its own ...

Read More →Have you ever felt like you're falling behind or wondered if you’re on the right track for a stress-free retirement?

Read More →How Public Company Executives Can Think Differently About Investing If you’re an executive at a publicly traded company, your daily routine is ...

Read More →