Managing your student loans can be stressful and confusing, especially as you begin practicing full- time. We can help you devise a strategy to manage your debt through refinancing, Public Service Loan Forgiveness (PSLF), and Income-Driven Repayment options.

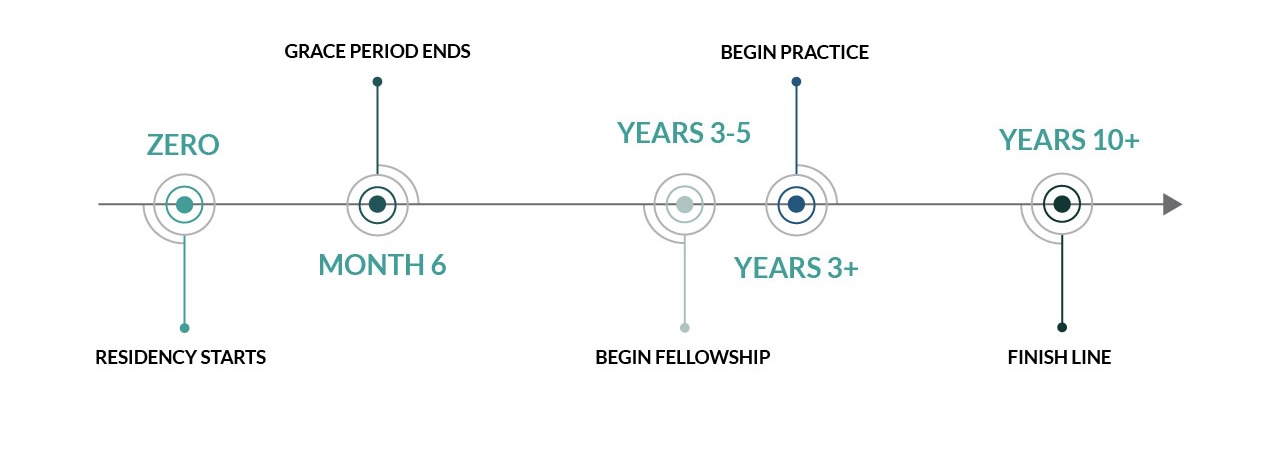

Through your education and career there are important windows of time to pay close attention to your student loans. We will guide you through these pivotal times to make sure you are taking advantage of all options to get your student loan debt conquered.

We have partnered with reputable lenders that offer favorable rates on student loan refinancing packages.

Your servicer may not be familiar with the Public Service Loan Forgiveness (PSLF) program's nuances. We can help:

You have repayment options, so make sure you explore them to find one that works best with your circumstances. We can help you determine a plan that will help you balance debt payoff.

Let one of our Student Loan Specialists help you understand your loans and your options.

Schedule a complimentary consultation with our Student Loan Specialists to take the first step of understanding your loans and your options.

I want to say to new graduates, the smartest thing I’ve ever done is find a financial planner who really cared about my goals and helped me get from point A to point B. The loyalty and relationship I’ve been able to form with my financial planner at SDT is something you don’t always find, and that’s the difference.