As we approach the end of 2022, the bear market, which began on the first trading day of this calendar year, is still roaring its ugly head. It still has a grip on our emotions, still has a grip on headlines, and still has a grip on the markets. And so, as we work through the confusion, uncertainty, and fear that comes, we want to bring some historical context, relevance, and information to you. One of our priorities is to help you make sense of what is happening instead of simply capitulating to the sensational headlines that swirl around us every day.

With that said, there is much we don't know, but we do know that in every bear market, there are opportunities. So whether you are at the tail end of your investing career and have been building a portfolio for many decades or starting out in your profession and are new in your savings and investing experience, there are opportunities.

Below we have included two charts that illustrate two different opportunities, depending on where you are relative to your goals and investing experience.

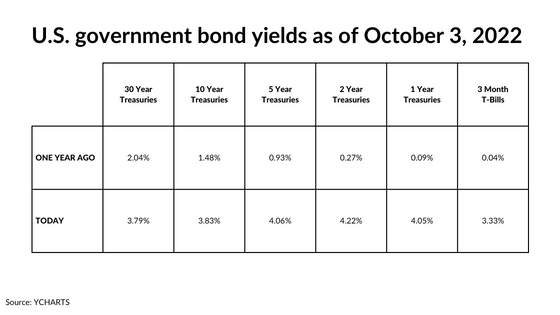

For those who have been investing for several decades, you may be in a position where you have built a portfolio. Now, you've felt discomfort watching the price of some of your investments drop by 20% - 30%. And that's hard. It does not feel good. We know that the Federal Reserve has been raising interest rates. In addition, we understand that the market has been pushing interest rates higher in response to inflation. And for the first time in nearly a decade, you can earn some interest on money market accounts, CDs, treasury bills, bonds, and funds.

You can see (on the chart above) a year ago, the yield on a five-year treasury bill was less than a percent, and now it's over 4%. We've seen the yield on two-year Treasuries go up by nearly eight times, or I should say almost 20 times. And so there is yield. Suppose a portion of your portfolio should be delegated to something stable with a return. In that case, the opportunity for you amid this bear market is that there are bonds, bond funds, and bond fund alternatives that finally are providing some sort of predictable return. And so that is the opportunity for those with a portfolio, savings, and long-term investments.

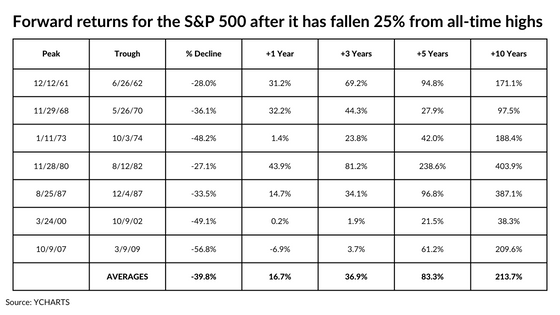

The current market can be very unnerving for those who are earlier in your investment journey, earlier in your careers and have just begun. It may very well be the first bear market in which you've ever had investments. As a result, it can be unclear how to proceed and understand the opportunity for you. Take a look at the chart below.

We know the market, in broad terms, is down about 25% now, and so we can look historically at the last seven bear markets and see what has happened next. And so, looking at the diagram on the screen here, we can see that looking at the forward activity of the S&P 500 after it has fallen 25% gives us this information. We can see that a couple of times in 1961 and 1980, the market bounced back after falling about 27-28%. In the other five circumstances, though, the market actually continued to draw down 30% or 40% creating a buying opportunity. Now, why do we say it's a buying opportunity?

Because one year later, the market has begun its consistent long-term rise back with returns of over 16%. Three years later, the markets returned over 37%. Five years later, the market has recovered nearly 80-90%. And so that's the opportunity for those who are starting out in life, investing, and buying high-quality, thoughtful investments regularly; the opportunity is to continue to do so. There, in fact, is a technical term for this – dollar cost averaging. I won't try to explain it here. Still, you can Google search that and see how dollar cost averaging can help reduce the average cost of your shares and therefore help mitigate some of the volatility you experience in a portfolio.

No matter where you are in your career and investment journey, the key is to remember that opportunities exist all around us if only we take the time to look for them and move forward with courage.

If you need help identifying opportunities with everything going on in the financial world, Spaugh Dameron Tenny is here to work with you and your specific situation.

CRN202512-3540403

Shane Tenny, CFP®, is the Managing Partner of Spaugh Dameron Tenny and a nationally recognized financial advisor. Since 2000, he has combined extensive financial knowledge with a passion for behavioral finance—helping clients make informed decisions based on both data and mindset. Shane often contributes to industry publications, appears as a guest on podcasts, and has been a leader in the financial planning field for years. He is known for making complex topics clear and practical for busy, high-income professionals seeking personalized advice they can trust.

One of the challenges of being in a high-earning profession — whether in healthcare, business leadership, or another demanding field — is making ...

Read More →Who’s Really Coordinating Your Financial Playbook? If you’ve ever felt like managing your finances is a full-time job on top of your actual full-time ...

Read More →Have you ever felt like you're falling behind or wondered if you’re on the right track for a stress-free retirement?

Read More →