I want to share some information and charts that will help set your year on the right foot as we look back at what happened and try to get an idea of where equity markets and investors might experience returns in 2024.

Learn more about the market outlook by watching this video or reading the article below.

2022 was one of the most challenging bear markets in recent memory, so it's important to take a moment and reflect a little bit on where we were and what happened.

Thinking back to the last year and a half, two of the major themes in the market were inflation and interest rates. The Federal Reserve was working feverishly and diligently to stem the increase in inflation while being gentle with unemployment and on equity markets.

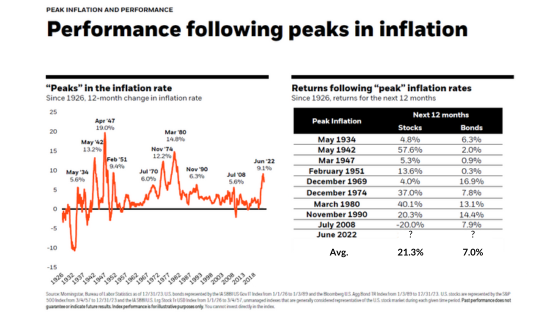

We all know that in mid-2022, inflation had peaked at 9.1%, as shown on the chart on the left. The Federal Reserve had already begun its aggressive campaign of raising interest rates to try and stem inflation.

Now, we know that in 2022, when inflation was peaking, it was also one of the most difficult bear markets for stocks and bonds. In every circumstance except for the great recession of 2008, equity markets had posted positive returns twelve months after a peak in inflation, which is highlighted on the chart on the right.

Of course, when I initially shared these charts a year ago, we didn't know what the returns would be twelve months after mid-2022. We only knew that the average equity market returns twelve months following a peak in inflation is 21.3%.

And what happened?

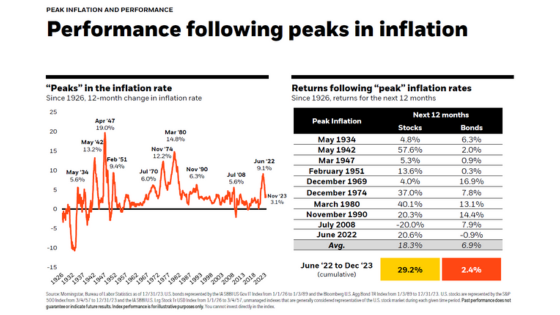

If we look at the chart completed through the end of last year, we know that inflation has dropped significantly, closing the year at about 3%, as illustrated in the red line on the left. We also see that the returns twelve months after 2022 were almost spot on with the average at about 20.6%.

If we broaden our perspective to include all of the market's returns for 2023, we see that the equity market returns and the yellow box at the bottom right were 29.2%, as measured from inflation's peak in mid-2022.

Now, that is not a prediction that we made; it is just a historical observation that we presented. I never know what exactly the market is going to do over the next quarter, the next year, or even the next two years, but we can use history as a guide. As Mark Twain said, "History doesn't repeat itself, but it often rhymes."

It's essential to know that the tool that the Federal Reserve used, and is using, to help stem inflation is the federal funds rate, which they've been raising since early in 2022. The last Fed funds rate increase was in July of 2023, and, historically, the Fed has begun reducing interest rates ten and a half months following the last rate increase.

Based on historical measurements, that would cause the first interest rate decrease to fall sometime in the second quarter of this year. I don't know that that's going to happen. As the Fed would say, it's always data-dependent, but it is something to note because as interest rates begin to decrease, the cost of capital becomes less, which often bodes well for equity market returns.

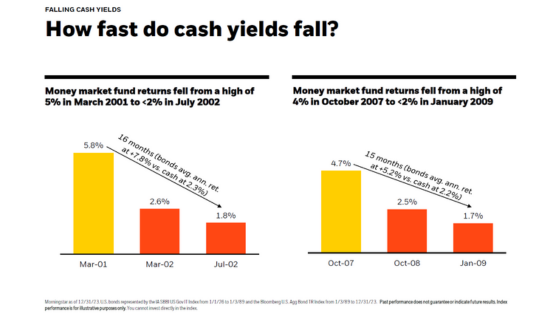

However, an important caveat here is that one of the benefits of rising interest rates has been the yield on money markets or high-yield savings accounts. Many of us are benefiting from having our cash, money markets, and high-yield savings growing at 4%.

Bear in mind that the party won't last forever. As you can see here, going back to the recession of Y2K from 2001 to 2002, we did see interest rates drop from about 6% to less than 2% in a matter of less than a year and a half. During the great recession of 2007 to 2008, we saw interest rates drop from about 5% to less than 2% in about 15 months.

So, if or when the Federal Reserve begins to reduce interest rates, you should expect a rapid drop in your money market funds yield and, therefore, perhaps an opportunity to deploy that cash in a more appropriate investment strategy for long-term returns.

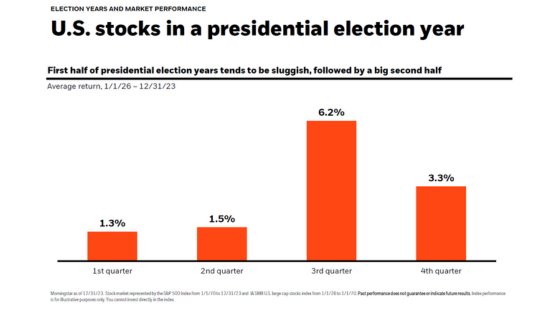

I also want to talk about another theme that you are undoubtedly hearing a lot about as we head into 2024: the presidential election. And while our portfolios are not directly invested in Washington or the White House or politics, it is interesting to look at historical trends of presidential election cycles.

Historically, the market has always provided positive returns, more often than not, but they don't come equally through every quarter. We can see here that the first half of the year in presidential election years tends to be sluggish compared to the second half of the year. But it raises an interesting question for the investor.

For those with cash on hand, would you rather hold the cash until the second half of the year when returns are already higher or would you rather deploy the cash in the first half of the year before prices have increased?

This is a question for you to discuss with your financial advisor but one that is worth asking.

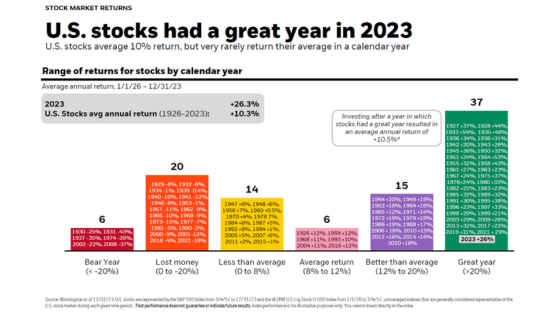

The final chart I want to share with you has to do with a big-picture view of equity markets. If we look at returns over nearly the last 100 years, let me ask you a few questions:

Sometimes, it feels like a coin toss. A year like 2022 is down, a year like 2023 is up. It's just a 50-50 chance whether the market will be up or down this year.

As you reflect on the questions, I want to bring you some data, because the fact of the matter is that equity markets in the last 98 years have only posted negative calendar year returns 26 times.

Only 26 times out of 98 years has the market been negative. For all the other time, the market has been positive.

Additionally, this average return of 10% that we hear about all the time doesn't happen every year. In fact, there are only six years out of the last 98 where the market's even been up between 8% and 12%. All the rest of the time, the market has been higher or lower.

You can see here that there have been more years that have been up more than 20% than there have been negative years in their entirety.

The 2023 equity markets were up 26%, marking the 37th year out of the last 98 when over one-third of the time equity prices were up in double digits, more than 20%. Take a minute and reflect on this chart as you look at the dispersion of positive returns in equity portfolios.

The main takeaway I want to offer is that the best way to benefit from the perpetual positive compounding of long-term returns is not to interrupt its work.

With the market constantly changing, feel reassured that there are really thoughtful people taking a really thoughtful look at your portfolio, your goals, and your future.

As always, if you have questions, please connect with an SDT financial planner. It is our pleasure and privilege to come alongside you to help navigate the decisions that are most applicable to your family.

Acknowledgment

Thank you to our friends at Capital Group for their help in providing information, research, and visual aids.

CRN202701-5762714

Shane Tenny, CFP®, is the Managing Partner of Spaugh Dameron Tenny and a nationally recognized financial advisor. Since 2000, he has combined extensive financial knowledge with a passion for behavioral finance—helping clients make informed decisions based on both data and mindset. Shane often contributes to industry publications, appears as a guest on podcasts, and has been a leader in the financial planning field for years. He is known for making complex topics clear and practical for busy, high-income professionals seeking personalized advice they can trust.

Finance has a reputation for being complicated, and not without reason. Like many specialized fields, it comes with its own language, acronyms, and ...

Read More →If I had a dollar for every time a new client made one of the comments below, I’d have … well, a lot more dollars.

Read More →At Spaugh Dameron Tenny, part of our role is helping clients start each year grounded in facts, not headlines, assumptions, or half-answers. When ...

Read More →