It's common to see blogs and articles touting the wonders of Roth IRAs. When you understand the tax characteristics of this particular type of account, it’s easy to see why. Once the money is deposited into a Roth IRA, it is never again subject to taxes. That means all of the growth on your Roth IRA is tax-free.

The problem many doctors and high-income earners face when it comes to Roth IRAs is that once you begin earning over the IRS’ stated income limit (around $160k single and $250k married filing jointly), you are no longer permitted to make direct Roth IRA contributions.

This is where the “backdoor” Roth IRA comes in.

The backdoor Roth IRA is not a different type of Roth IRA account. Rather, it informally refers to the method through which high-income earners can fund a Roth IRA in an IRS-sanctioned way. Instead of contributing to a Roth IRA, you convert funds from a Traditional IRA to your Roth IRA.

In this article, you will find helpful tips for reporting your backdoor Roth IRA conversions on your tax return.

You will likely not receive a backdoor Roth IRA tax form by the tax filing deadline if you did not complete the transaction in the calendar year of the tax return you are filing (transaction between 1/1/24 and 12/31/24 for 2024 taxes). However, you can still report your Roth IRA conversion without the tax forms.

Roth IRA conversions can be funded for the prior year up until the tax filing deadline — not including extensions (along with other tax items like HSA contributions). For example, if you forgot to complete your 2024 Roth IRA conversion, you may still be able to complete the transaction up until April 15, 2025.

While the contribution to the Traditional IRA is reported on the 2024 tax return, even if you made the contribution between 1/1/25 and 4/15/25, the conversion from the Traditional IRA to the Roth IRA will not be reported until you file your 2025 taxes.

The conversion transaction is reported on the year’s tax return in which you actually completed the conversion.

Three different tax documents will be produced as a result of the Roth IRA. Two of the documents will be associated with the Traditional IRA that you used for the transaction (Forms 5498 and 1099-R), and the other will be associated with the Roth IRA (Form 5498).

Note that some 5498s will not be available before the normal tax filing deadline. They are not required to report the backdoor Roth IRA correctly. You simply need to know the contribution amount deposited into the Traditional IRA and the conversion amount deposited into the Roth IRA.

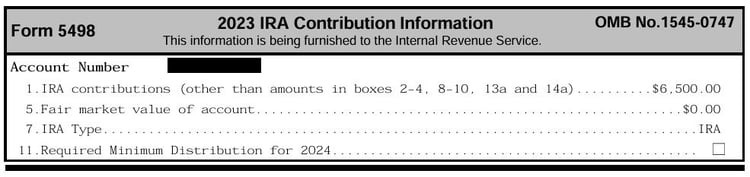

The Traditional IRA 5498 reports the amount contributed to the Traditional IRA. It will look something like this:

The IRA contribution limit for 2024 was increased from $6,500 to $7,000.

Often, for high-income earners who only use their Traditional IRAs to facilitate backdoor Roth IRA conversions, their Traditional IRAs sit empty and dormant most of the year. And it will have a fair market value of $0.00 most of the time, as seen above.

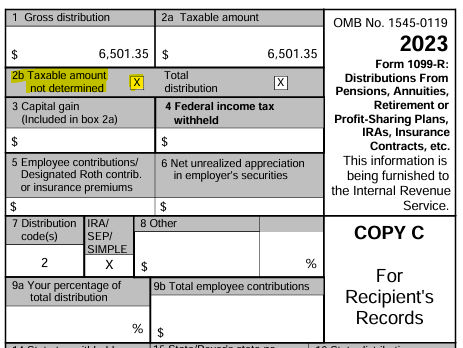

The 1099-R for the Traditional IRA reports the amount that was “distributed” from the Traditional IRA account. In this case, the funds were distributed or converted to the Roth IRA.

Usually, the 1099-R will show that the amount distributed was approximately the amount that was contributed to the Traditional IRA (give or take some interest earnings).

So, for instance, the 1099-R form will look something like this:

The custodian or financial institution has no way of knowing what type of transaction you are completing. They are simply reporting the deposits and withdrawals from the account.

You will notice that box 2a (above) shows that the entire gross distribution was a “taxable amount” because it comes from a Traditional IRA, which is usually a pre-tax account. In box 2b, the custodian admits they don’t really know the taxable amount — “taxable amount not determined.”

More on what the taxable amount should be when discussing IRS Form 8606 below.

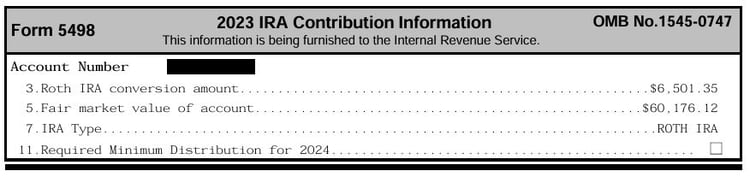

The final tax document you should receive is another Form 5498, reporting the conversion of funds into your Roth IRA. The Roth IRA conversion amount should usually match the distributed amount from the 1099-R.

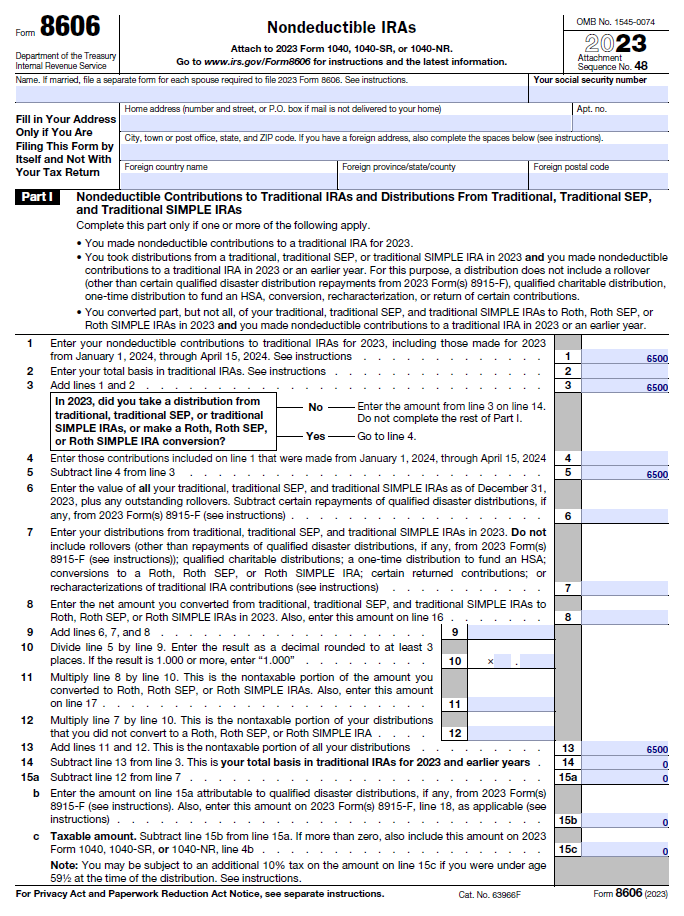

Form 8606 is the key to reporting backdoor Roth IRAs successfully.

The tax form, which is filed as part of your overall return, reports to the IRS that the Traditional IRA contribution you made to start the process of the backdoor Roth IRA was not deductible. In other words, you are not taking a tax deduction for the Traditional IRA contribution.

In essence, this maintains the “after-tax” status of those dollars and allows the conversion from the Traditional IRA to the Roth IRA to be a non-taxable event. This is referred to as having basis in the Traditional IRA.

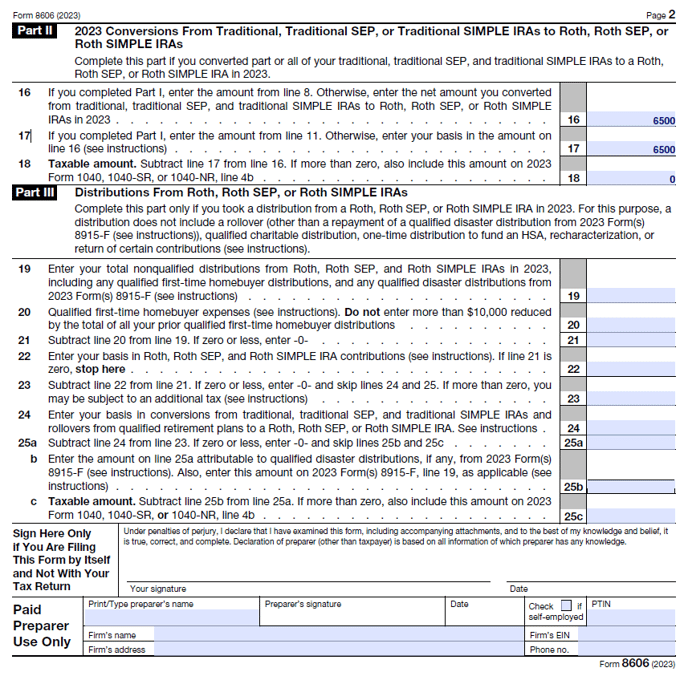

For example, Form 8606 may look something like this:

Page 2

If you do not report the Traditional IRA as nondeductible, you may pay unnecessary taxes on the distribution/conversion from the Traditional IRA to the Roth IRA. This could cost you!

One way to double-check that you are reporting the backdoor Roth IRA correctly and not paying unnecessary taxes is by checking line 4 of Form 1040 (found on page 1 of your tax return). Unless you completed another IRA distribution, it should match the amount from your 1099-R, and most likely, line 4b should be $0.

It may look something like this:

![]()

It should come as no surprise that there tends to be confusion about backdoor Roth IRAs. While everyone seems to have a general idea that Roth IRAs are good, they are not clear on why and whether high-income earners are allowed to use them.

Backdoor Roth IRAs can be great for physicians, dentists, business executives, and other high-income earners planning for retirement. However, they can be tricky. Therefore, it is essential to report them properly on your tax return to avoid unnecessary taxes.

Be sure to consult your CPA if you have specific questions regarding your situation.

The 2023 tax forms used in the blog will be updated once 2024 tax documents are fully issued.

Any discussion of taxes is for general information purposes only, does not purport to be complete or cover every situation, and should not be construed as legal, tax, or accounting advice. Clients should confer with their qualified legal, tax, and accounting advisors as appropriate.

Word of caution: People run into unintended backdoor Roth IRA tax consequences when they have existing traditional IRA funds, including SIMPLE IRAs, SEP IRAs, and 401(k) funds that were rolled over into an IRA. That’s because of the backdoor Roth IRA pro-rata rule, which treats all your non-Roth IRAs as one. If you have a pre-tax IRA, attempting back door Roth conversions can add significant, undesirable complexity to your future tax situation. Make sure to consult with your tax professional and financial planner before doing a backdoor Roth conversion to avoid any unpleasant surprises.

CRN202803-8222561

Will Koster, CFP®, is a financial advisor at Spaugh Dameron Tenny, where he helps high-net-worth professionals develop personalized, long-term financial strategies. Motivated by personal experience and a passion for meaningful planning, Will specializes in providing comprehensive financial guidance. He holds the CERTIFIED FINANCIAL PLANNER® and Certified Student Loan Professional® designations, along with Series 7 and 66 licenses. Committed to building lasting relationships, Will works closely with clients to align their finances with their values, enabling them to focus on what truly matters.

At Spaugh Dameron Tenny, part of our role is helping clients start each year grounded in facts, not headlines, assumptions, or half-answers. When ...

Read More →Each year, our team of financial advisors receives a steady flow of questions about the best ways to approach charitable giving during the last ...

Read More →Understanding how much you can contribute toward retirement each year helps you stay on track with long-term financial goals and avoid surprises at ...

Read More →