If you've ever thought about working with a financial planner, you might have wondered how much would it cost?

It’s obvious that you can handle your own finances, just as you can prepare your own taxes or negotiate your own employment contract. With busy schedules, doctors are often forced to way their options of hiring a professional who they can delegate important financial tasks to versus making decisions on their own about student loan repayment strategies, home buying, disability insurance, budgeting, retirement planning, and much more.

You might have the temperament to learn about personal finances and make decisions on your own, but do you have the time to do so? If you decide you want to work with a financial planner, it’s important to understand the different types of financial planner firms and how they get paid.

After all, the goal is to get more money out than you put in when it comes to paying for your financial professional.

The actual cost of engaging with a financial planner will vary based on your geography, their experience and the scope of advice you're looking for. Financial planners tend to work under one of three different billing methods. Let’s talk about each financial planning model to help you understand how much a financial plan can cost.

Watch this video to hear me explain the cost of financial planners:

What's the Cost Breakdown? Financial Advisor Fee Comparison

There are many different types of pricing models that financial advisors use to decide how much they will charge their clients. The most popular pricing models include the fee-only, assets under management (AUM), and the blended compensation model. Here are some of the differences between the different advisor models.

The first financial planning fee model is called the retainer or the direct fee method, also commonly known as a fee-only advisor.

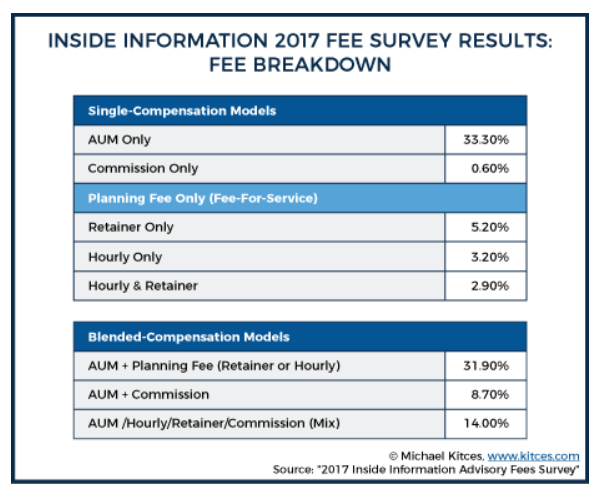

According to the 2017 Inside Information Advisory Fees Survey, the direct fee model is used by only about 15% of financial planners across the country.

In the direct fee method, there is a flat fee that's billed to you either at the onset of the relationship or at some regular interval.

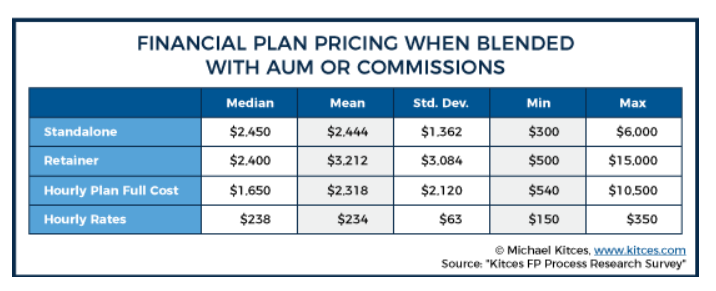

What are the fee-only financial planner rates? The chart below shows three different fee-only models, because a retainer may be a monthly subscription fee that you pay directly or an annual renewal fee you'll pay to engage with your financial planner. According to Michael Kitces, a financial planning researcher, the flat annual fee (retainer) typically ranges from $3,000 to $15,000.

In some cases, the retainer model can even be structured as an hourly rate. When your financial professional is working for you or providing advice, the typically bill $200 to $400 per hour. Per-plan or stand-alone fees may range from $2,500 to $6,000.

Often in the direct fee method, there is not as much support with the implementation of the plan once it’s delivered. This is not always the case, but typically this type of financial planner will provide thorough analysis of your situation within the scope of your engagement, but then you'll need to implement and execute their suggestions on your own. This means fee-only model may not include the cost of investment management or other products your financial professional might prescribe for you, such as disability insurance, life insurance, or an annuity.

One of the oldest and most common billing methods is known as the assets under management or the AUM method of billing. According to the Financial Planning Association, this fee model is used by 82% of financial advisors.

In the AUM model, there is usually a requirement that a portion of your assets must be professionally managed by the financial planning firm. In doing this, they will assess a percentage fee on the total account value.

For example, it may be a 1% fee based on the amount of your investment account, on an annual basis. This fee is typically debited directly from the account on a quarterly or sometimes monthly basis. In exchange for this fee, the firm will not only provide investment allocation, oversight and some direction on your investment portfolio, but they'll also generally provide some sort of financial planning advice.

The fee isn't contingent on which type of strategy or how much trading there is, which is why it is typically considered a fiduciary fee. In exchange for that fee, which is conveniently debited from the account and not from your checking account or credit card, the advisor will provide oversight of the account allocation service assistance. In addition to providing tax forms, the fee will also include some level of financial planning advice outside of investments. This type of advisor will also cover some level of financial planning advice and scope outside of just investments.

In general, the blended compensation model is a hybrid of investment management percentage, direct planning fee, and/or commissions from insurance carriers. While it may appear this would result in a significantly higher fee, the ability for a firm to generate revenue through multiple channels often allows a reduction in the directly billed portion of the planning fee. As you can see in the chart below, over half of the financial planning firms across the country operate on a blended fee schedule.

The blended model means the firm bills some direct fee to you while also providing investment oversight services for a fiduciary fee or a percentage of the account value.

This type of firm will engage in implementation support. After the diagnostic and analysis is run and the financial plan is presented to the client, a fee-based financial planner will assist you with insurance and investment services. They charge commissions and investment fees to ensure quality service on those accounts and policies is provided. The blended model allows your planner to offer a broad scope of advice so they can help you implement their recommendations with turnkey support along the way.

There are many nuances when comparing three different types of financial planning services models. Remember geography, an advisors’ experience, and the cope of service you are looking for will always factor into the cost of your financial plan. The charts above show that charging a percentage AUM fee can help lower retainer fees, resulting in a more even playing field between the three types of fee models.

As you can see, there is an abundance of options when it comes to types of financial planning firms. It can be challenging to discern whether a financial planner will be a good fit for you when you when you first land on their website or have an initial meeting with them. A good financial planner can take stress off of you and help you make smart decisions with your money. When interviewing financial planners, make sure you ask questions to help you understand how they will help you and ultimately get paid.

To dive deeper into what a comprehensive financial plan should be comprised of, download the SDT Financial Survival Guide.

CRN202209-271725

Shane Tenny, CFP®, is the Managing Partner of Spaugh Dameron Tenny and a nationally recognized financial advisor. Since 2000, he has combined extensive financial knowledge with a passion for behavioral finance—helping clients make informed decisions based on both data and mindset. Shane often contributes to industry publications, appears as a guest on podcasts, and has been a leader in the financial planning field for years. He is known for making complex topics clear and practical for busy, high-income professionals seeking personalized advice they can trust.

Finance has a reputation for being complicated, and not without reason. Like many specialized fields, it comes with its own language, acronyms, and ...

Read More →If I had a dollar for every time a new client made one of the comments below, I’d have … well, a lot more dollars.

Read More →At Spaugh Dameron Tenny, part of our role is helping clients start each year grounded in facts, not headlines, assumptions, or half-answers. When ...

Read More →