One of the most meaningful aspects of accumulating wealth is the ability to give back. Families and individuals donate for a variety of reasons. Making these gifts in a tax-efficient manner is typically a secondary consideration. Despite this, tax benefits for charitable giving exist, and what better way to maximize your wealth than through tax-efficient gifts.

A slightly more complex gifting strategy than giving cash is the ability to gift assets that have appreciated in value. As a retiree, you have likely accumulated an investment portfolio made up of non-qualified investments. These investments - mutual funds, stocks, bonds, or exchange-traded funds - are eligible to be gifted directly to your charity of choice. Gifting directly to your charitable organization allows you to avoid selling your asset and incurring possible capital gains taxes. In addition, donating directly to your charitable entity using appreciated assets will provide you with an income tax deduction equal to the fair market value of the asset you donate, up to 30% of your Adjusted Gross Income (AGI).

Example: You purchased ten shares of XYZ Company in 2010 when it cost $100 per share ($1,000 total). The shares are now worth $50,000. If you gift your shares of XYZ Company to your favorite charity, you could be eligible for a $50,000 tax deduction and avoid incurring the capital gains ($49,000) on the sale of your XYZ Company shares.

If you like the concept in the previous strategy but are not ready to designate your charitable gift recipient(s), a Donor-Advised Fund may fill that void. A Donor-Advised Fund is a philanthropic vehicle established to allow donors to make a charitable contribution, receive an immediate tax benefit, and then recommend grants from the fund over time. Donor-Advised Funds are also designed to easily facilitate the gifting of appreciated assets (stocks, bonds, mutual funds, etc.) to make your charitable giving more tax effective.

Like in the previous example, you own ten shares of XYZ Company with unrealized gains of $49,000 and a total value of $50,000. However, suppose you are not prepared to designate your charity but would like to take a tax deduction immediately. In that case, you can elect to establish a donor-advised fund, gift your ten shares of XYZ and make charitable grants over time. Remember, with a DAF, the tax benefit is given in the year when you have gifted the stock to your DAF, not when you make the charitable grants.

A commonly used strategy for retirees age70½ or older is called the qualified charitable distribution (QCD). This strategy enables you to gift IRA assets directly to a charitable organization (up to $100,000 annually). This benefits you, the grantor, since your distributions count towards your required minimum distributions (RMD), but you don't realize any taxable income. The gift does not qualify for a tax deduction, but since it won't be considered as taxable income, it could benefit you as it relates to your Medicare Part B and Part D premiums. Since those premiums are based on your previous year's modified adjusted gross income, avoiding or reducing your RMD could lower your income-related monthly adjustment amount (IRMAA). IRMAA is used to calculate the amount of your Medicare Part B and Part D premiums. See below table below.

Medicare Part B And Part D Prescription Drug Coverage for the Year 2022 IRMAA Table

Married Filing Jointly

As you can see, the jump from $228,000 of income to $340,000 of income could more than double your monthly premium.

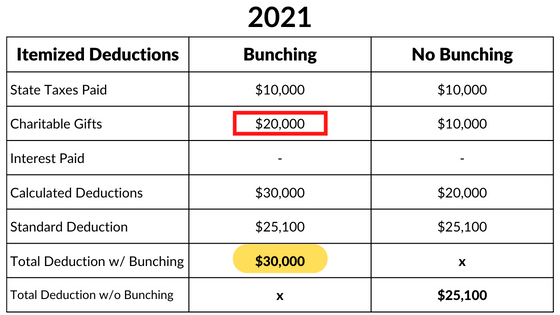

It's common for many retirees to have their mortgage paid off and their incomes, on paper, reduced from their highest earnings years. This combination often changes the way in which a retiree takes deductions. You might consider "bunching" your charitable gifts into one tax year to make your itemized deductions exceed the standard deduction.

*Example: John and Jane Doe gift $10,000 per year to their church, maximize their state and local tax deduction on their tax return ($10,000), and have no mortgage interest to deduct. If they were to "bunch" their charitable contributions in one tax year, their tax deduction for 2021 could have been $4,900 more than what they took. See the example below.

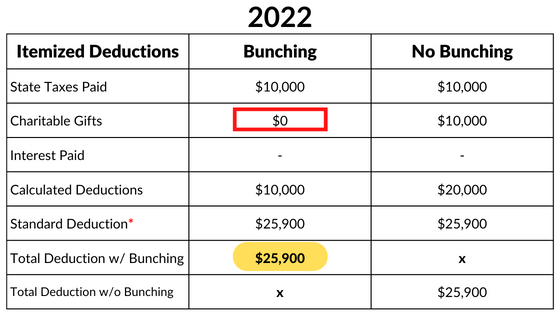

Now, because they made all their charitable contributions for two tax years in the tax year 2021, in 2022, they will not make any charitable contributions. As seen below.

As you can see, over two tax years (2021 and 2022), John and Jane would have received an additional $4,900 worth of deductions if they used the charitable bunching strategy with potential tax savings of up to $1,800 (assumes 37% tax bracket).

*Example is for illustrative purposes only. Consult your tax advisor related to your personal situation.

Charitable giving can be rewarding for all those involved, the grantor, along with the institution and individuals receiving the gifts. But the reward doesn't have to be solely euphoric in nature; using one of the strategies listed above, your charitable endeavors can also be financially rewarding.

Through personal financial planning, we at SDT drive to equip our clients to make decisions so that they feel secure, free, and successful, and we inspire them to a legacy of generosity and stewardship. Please schedule a conversation with one of our financial planners if you are interested in learning more.

CRN202508-2834661

Jordan Bilodeau, CFP®, CEPA, is the Director of Planning & Strategy at Spaugh Dameron Tenny, where he leads firmwide planning initiatives and helps clients navigate complex financial decisions. With experience in portfolio design, tax strategies, and business succession planning, Jordan works with executives, physicians, dentists, and successful retirees to coordinate every aspect of their financial lives. He holds both the CERTIFIED FINANCIAL PLANNER® and Certified Exit Planning Advisor designations and has a Master’s degree in Wealth and Trust Management, providing tailored guidance for clients.

Finance has a reputation for being complicated, and not without reason. Like many specialized fields, it comes with its own language, acronyms, and ...

Read More →If I had a dollar for every time a new client made one of the comments below, I’d have … well, a lot more dollars.

Read More →A Roth IRA is a tax-advantaged individual retirement account that allows qualified withdrawals to be made tax-free. Unlike a Traditional IRA, Roth ...

Read More →