Every financial decision has an impact on your future. For physicians, the many life changes from school, to training, practice, and then retirement often result in many transactions – multiple bank accounts, insurance policies, investments, annuities, and more. After some time, if you’re like most physicians, things may get away from you.

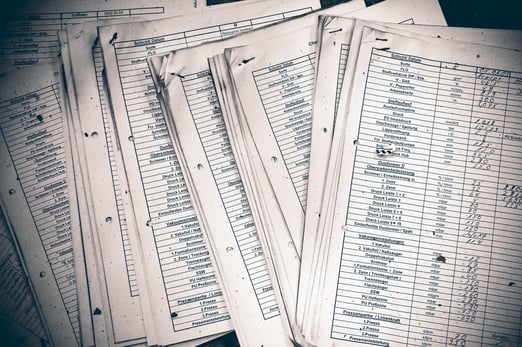

Just like the junk drawer most of us have, your financial junk drawer accumulates over your career. Yours may be full of various financial accounts, including old retirement accounts from residency, insurance policies, Roth IRAs, 529 plans, wills, or trusts, to name a few. The accounts are inherently important but are left in a useless pile with outdated information.

Decide what is most important when it comes to your finances at this point in your life. Is it saving for your kids’ education or buying into a practice? Do you want to reduce your debt, curtail your spending and lifestyle habits, build a retirement nest egg or leave a legacy? Deciding what is most important to you right now can help create a clear plan for your financial and investment plans.

Make a complete inventory of what you own and what you owe. What you own makes up your assets. These can include your saving accounts, home, car, retirement plans, mutual funds, stocks, bonds, annuities, or cash value life insurance. What you owe are your liabilities such as your student loans, mortgage, or car loan. List each of your assets and liabilities, then Include what each is tied to. Knowing what you own and what you owe can help determine your budget and add to what you need to pay off during your immediate financial plan.

Now that you know what you own and what you owe, you can identify your risks. Common risks are being out of work due to sickness or an accident, death, a lawsuit, market volatility, or taxes. This is when your newly organized list of accounts comes in. Do you already have protection for the risks you have identified? If not, determine the common risks that aren’t linked to your current insurance or retirement accounts and find the best protection. Planning for uncertainties and accidents can help determine what you need to set aside in your emergency fund. Nothing is worse than encountering a scenario where you cannot maintain your cash flow and not having funds set aside.

Connect what you have and what you owe into a strategy to achieve your goals and reduce your risk. You should now have a clear and concise view of your finances. Every product or account you have should be serving a purpose. Discern if a product is either protecting your wealth or growing it – if not, get rid of it or update it.

If this task seems overwhelming, work with a financial planning professional to assist you in going through the steps of organizing your financial junk drawer. An advisor can help you move forward knowing you are on track to reach your financial goals while suggesting strategies to improve your financial plan.

6 Money Decisions for Physicians and Dentists

The 4 Financial Stages of Physicians

CRN202010-238797

John Dameron has been a financial planner and partner with Spaugh Dameron Tenny since 2002. With the help of the SDT team, John created a lecture series called Physicians Financial Focus, authored a book entitled The Residents and Fellows Financial Survival Guide, and has coached hundreds of physicians from residency/fellowship into practice. His expertise has also been featured on KevinMD.

Whether you're launching your career, navigating a major life change, or preparing for retirement, it's never too early or too late to benefit from ...

Read More →This year, April 15th is the deadline to file your 2024 tax return, and it is quickly approaching. Whether you work with a CPA or another trusted tax ...

Read More →For those with significant financial success, a bonus represents more than just extra income. It’s a chance to create meaningful progress toward your ...

Read More →