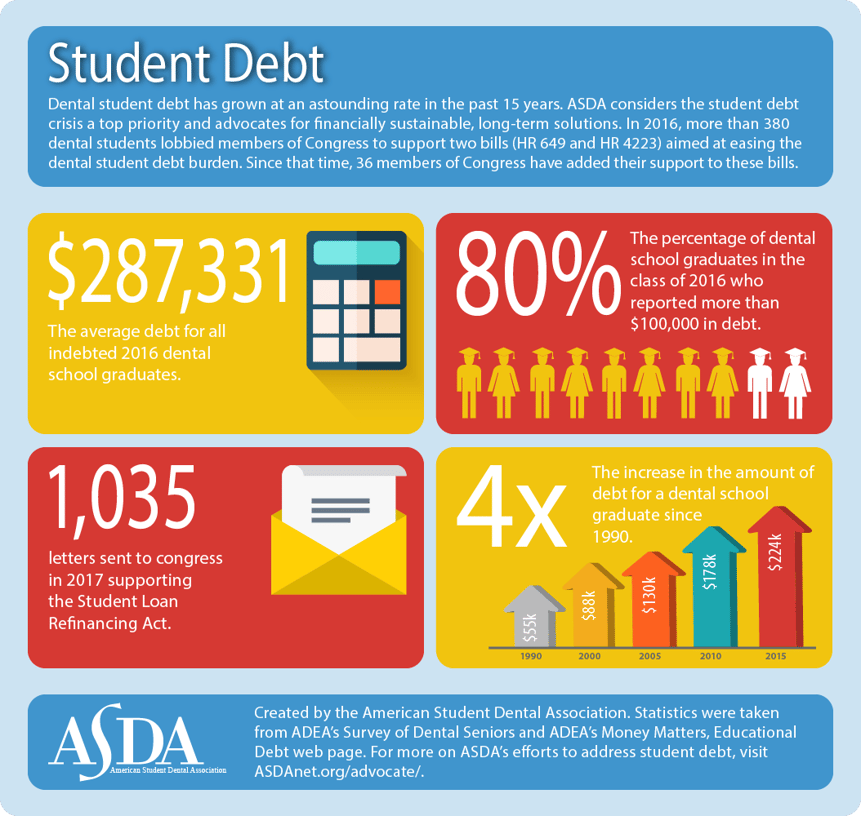

Often talking with newly minted dentist, they feel confused or frustrated with their student loans. According to the American Dental Education Association (ADEA), the average debt per graduating senior is $287,331 and the infograph below displays dental school student debt has increased four times since 1990 . This high level of student debt can bring stress and ultimately affect dentists' career path. There is no shortage of information available between online research, fellow colleagues, dental school friends, or academic advisors.

However, the challenge many new dentists find is deciphering all of the available information, determining an appropriate strategy, and the impact it may have on current finances and future goals. Do you plan to own your own practice, pay off your student loans as soon as possible, buy a house, travel, or invest? In addition to your goals, it can also be difficult to navigate the six different ways to handle student debt that come to mind, which include standard repayment, extended repayment, income-driven repayment, public service student loan forgiveness, deferment, training deferment, refinancing, forbearance, and consolidation. Contrary to popular belief, student loan repayment is not a one-size-fits-all approach.

Before you choose any of the six options, you should also consider these important factors: your current budget, projected income and expenses, tax implications, interest rates, additional debt, and the career path you have in mind.

Furthermore, if you delay making payments towards your student loans, it may cause interest and principle to grow. But, committing too monthly payment that is too high may cause complications when applying for a mortgage or practice financing. As mentioned, it is also important to consider if you have any other debt from your car, credit cards, or mortgage.

Refinancing student loans is also an option and you may be wondering if its appropriate for you. refinancing student loans is also available and as I mentioned, every dentist's situation is different. Here are eight factors to consider when thinking about refinancing you student debt:

(1) How much discretionary income do you have left over?

(2) Would refinancing disqualify you for a mortgage or financing your own practice?

(3) You will be locked into the rate and length of payment.

(4) Income driven repayments are generally not available.

(5) Refinancing may require a co-signer.

(6) Potential loss of forgiveness at death.

(7) Preferred lenders through professional association may offer additional discounts.

There are several factors to consider when dealing with your dental student debt. If you are overwhelmed with the financial decisions you are facing as you transition from training to practice, a financial planner can help you figure out a strategy that works best for your unique situation.

Don’t let the feeling of fear or confusion limit your ability to achieve what is important to you.

Photo Source | CRN202011-240060

Similar Posts:

Millennial Dentist Pushing the Pedal to the Floor

Partner and Financial Planning at Spaugh Dameron Tenny.

Over the past several weeks, major developments have affected the federal student loan landscape. For the first time in over three years, payments ...

Read More →Have you worked at a not-for-profit or governmental organization for at least 10 years of your career? Do you still have student loans? Do you know ...

Read More →As a result of the COVID-19 pandemic, the automatic federal student loan forbearance put in place by the CARES Act in March 2020 has been extended ...

Read More →