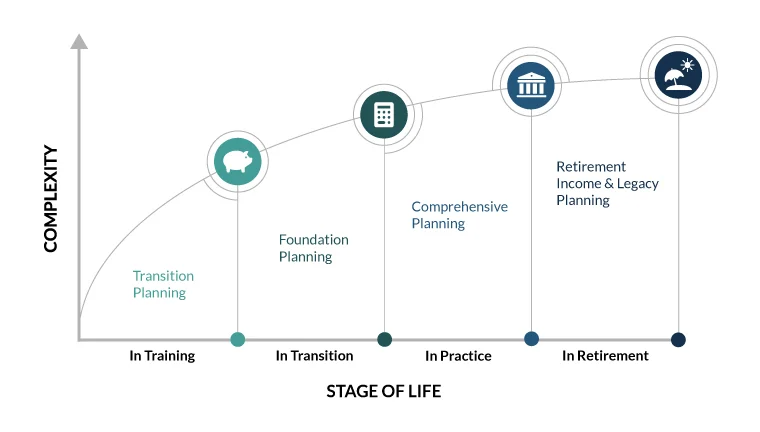

More money doesn’t make planning easier. It’s not too early to start thinking about your financial situation. You may not realize it, but you’re making decisions already.

A sound financial plan is comprehensive and tailored to your current and prospective needs. We provide solutions in student loan consolidation, protection planning, wealth management, retirement fortification, and everything in between.

More money doesn’t make planning easier. It’s not too early to start thinking about your financial situation. You may not realize it, but you’re making decisions already.

Learn how to manage the money you’re making after you’ve settled into your career and practice. The right financial decisions now make a big impact - we call it "preventive financial care".

The financial choices you make daily influence you and your family’s future. Stay involved in your financial development with deliberate decision making strategies.

Your financial needs change as you approach retirement after a meaningful career. Enjoy a secure retirement by your design and plan so you can leave a lasting legacy.

You need to plan for the future and your pending financial needs, decisions, and roadblocks. We offer expertise in insurance, investments, retirement, and more—anything you need to reinforce your financial path.

With medical education, there is potential for substantial debt, but that doesn’t mean it has to control your life. Our certified student loan experts will guide you through your options, from refinancing, consolidation, repayment and Public Service Loan Forgiveness.

We can support the smart financial decisions for your practice, too. We offer supplemental benefit and 401(k) plans for your team, insurance solutions, and entity structure and strategic planning for your future practice partnerships.

Ready to expand your financial knowledge? Our team of financial experts has compiled a library full of resources hand-selected to help you navigate some of the most important life decisions you will ever make. Here you will find blogs covering the latest pro-tips and financial trends, podcasts addressing common financial concerns in the medical industry, how-to videos, and more.