You may not know it, but you are probably already a dollar cost average investor! Do you contribute to your 401(k) or Roth IRA every month? Making these small contributions with every paycheck is a great example of the dollar cost averaging investing strategy.

When the economy is bad and everyone is feeling queasy, you might think it’s a risky time to invest. One of an investor’s main goals is to buy at the best (lowest) price. Instead of trying to magically time the market, dollar cost averaging can help you balance out your returns.

Taking a bet on the stock market is a risky move, especially when there is economic turmoil and no strategy in place. Whether you are buying stocks, mutual funds, or other investment vehicles, understanding how dollar cost averaging works can help you build a sound investment strategy.

Dollar-cost averaging is a system of subsequent periodic purchases that allow an investor to manage their risk. This is a way to invest the amount of cash you've identified in smaller increments over time – as opposed to investing that lump sum all at once.

Is it appropriate to invest all the cash you've identified at once? It might be more sensible, in line with your comfort level and financial goals to reduce your risk by dollar cost averaging. This investing strategy takes the emotions out of investing by creating a consistent contribution to your retirement or other investment account, no matter what the market is doing.

Timing the market is a gamble, like trying to buy gas at the best price. Like the stock market, gas prices are impacted by many economic factors. Gas prices fluctuate due to crude oil supplies, seasonal changes, and demand. When gas prices normally peak in the summer due to high travel, a global pandemic can cause unexpected shifts in prices. Just as COVID-19 has affected demand in gas, it has also wreaked havoc on the stock market, in addition to surprising growth.

Would you have predicted the 40% S&P 500 rebound – touted as the best rally the stock market has over that period of time in 80 years –after falling more than 33% in late March of 2020? To avoid the challenge of predicting stock prices, dollar-cost averaging allows an investor to passively time the market. You’re investing the same amount each month, while buying less when the market is high andmore when it’s low. For example, instead of putting $100,000 all to work right now. You could choose to invest it $20,000 a month over the next five months to hedge against any continued volatility through the balance of this year.

Let’s take it further with a more detailed scenario to compare dollar-cost averaging to buying with a lump sum of money and holding that investment.

So, what is the difference between buy & hold and dollar cost averaging? In 2008, the Bank of America stock dropped from $40 per share to $10 per share. We had clients who thought ‘this is a buying opportunity, let’s buy at 10/share!’ Was this a good strategy? Let’s look at this example to find out.

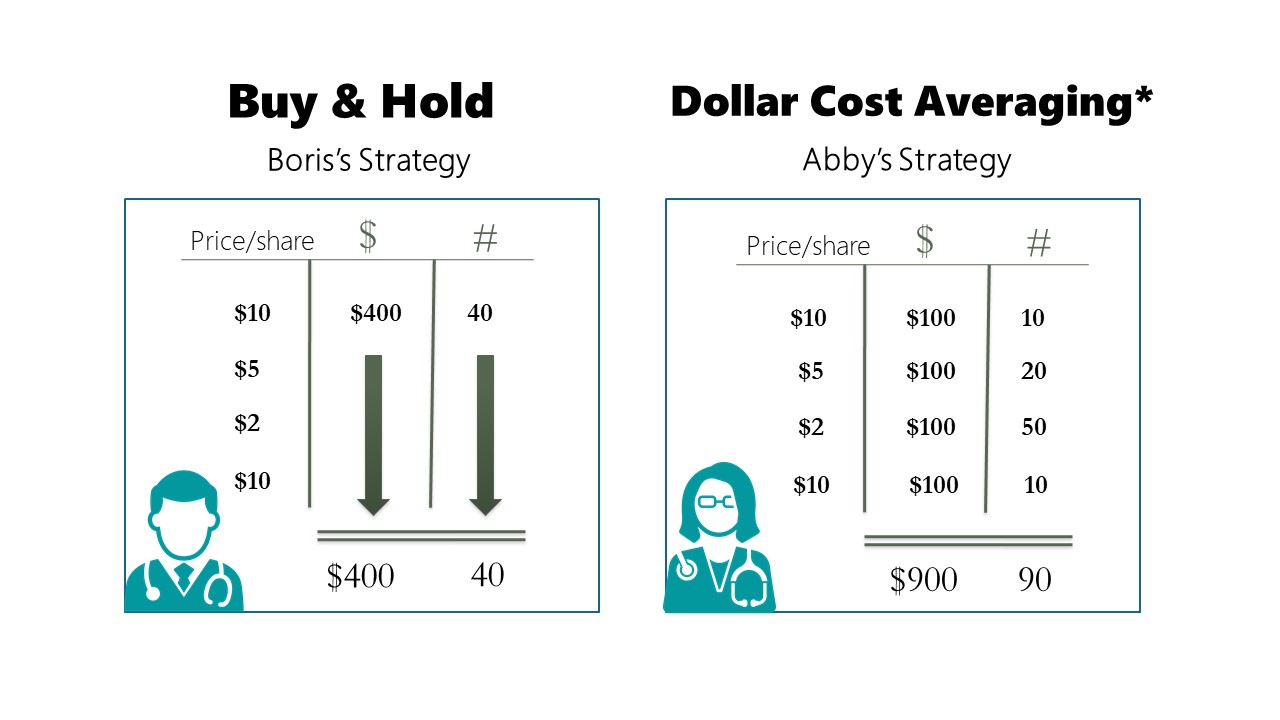

Boris (left) will be the investor who chooses to invest a lump sum (or buy & hold), while Abby (right) chooses the dollar cost averaging strategy. Both Boris and Abby decide that this stock looks like too great a deal to pass up.

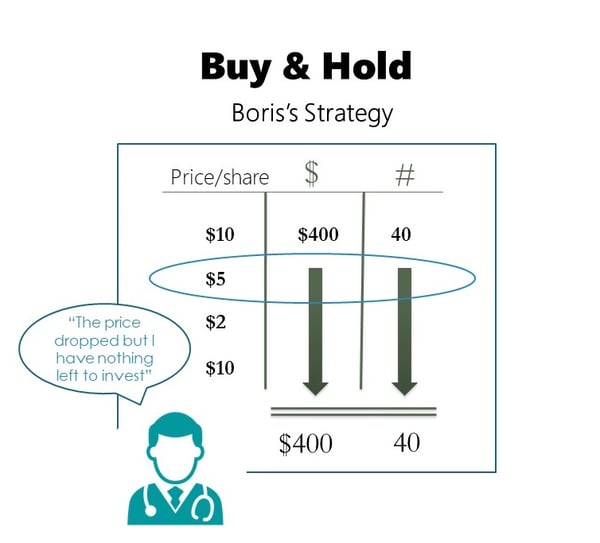

The left of the image above shows Boris’s strategy – he goes all in and buys $400 worth of Bank of America stock at $10 per share, totaling 40 shares. He thinks this is a steal, and he’s excited.

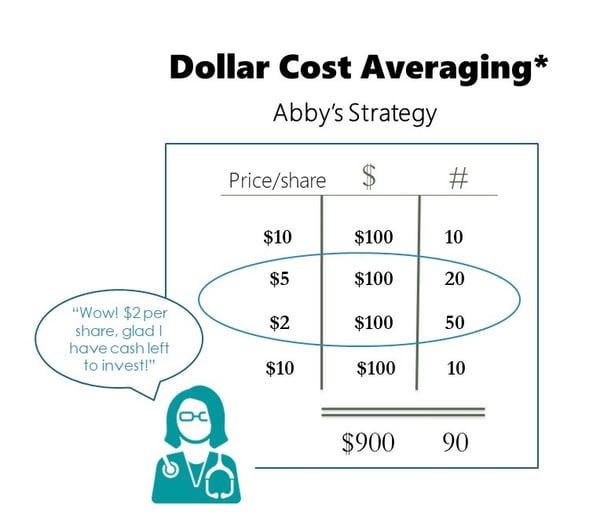

Abby wants to buy into the Bank of America stock as well, but years ago, she went to a lecture by a very shrewd, intelligent, and witty financial planner, and she learned of a strategy she wants to employ with this appealing deal. She’s not going to put all your money in today, she’s going to invest $100 today and break her investment into 4 equal installments at $100/month for the next four months.

In the first month, Abby invests $100 and gets 10 shares of stock. Now the next month comes along, and the stock has gone from $10 to $5. Now Boris has no more money to invest, but does have 40 shares of stock, now worth $200. Boris is feeling a little discouraged.

At $5 a share, Abby is going to stick with her game plan, so she invests $100, buying another 20 shares. The third month comes along, Bank of America bottoms out at about $2/share. Boris’s 40 shares are now worth about $80. He has massive indigestion, and his conviction about this stock has crumbled. He’s thinking he will sell out and take a massive loss, a $320 hit, and never invest again!

Abby, on the other hand, says “it can’t go much lower than this!” invests the third $100, gets 50 shares. Now, the stock rebounds and goes back to $10/share. If Boris didn’t sell, he’s now back to zero, sells, gets his money back, says ‘that was a nauseating ride, I’m outta here’. In this scenario, Boris’s rate of return was zero and an awful lot of heartburn.

Abby still has the last $100, the final investment results in the purchase of 10 more shares, winding up with a total of 90 shares. Abby says: “you know what, I’m going to get out too.” So at $10 a share, Abby sells, and gets $900 on an initial investment of $400. That’s about a 125% rate of return.

Now that you’re excited that you could possibly see 125% returns, remember there is always a risk to investing, no matter what strategy you choose to employ. There are trained investment professionals responsible for allocating your withdrawals from your paycheck to your 401(k). Always err on the side of caution when investing on your own. To help you determine if you’re ready to invest on your own, ask yourself: would investing now and using your available cash that is currently in your savings account align with your goals? When you invest, you are parting with your money, therefore it is not liquid or easily accessible. It should be a long-term proposition because in the short-term we can’t predict what will happen in the stock market.

Before you begin investing outside of your employee retirement account, make sure you are prepared with all the following:

(1) Employment or secure income

(2) You have built an emergency fund (six months of expenses is ideal)

(3) You have paid off high-interest-rate debt like credit cards or student loans

The point of this article is not to give you the message that dollar cost averaging will inherently cause you to double your money, the point is that it’s important to be intentional about how we invest. Dollar cost averaging helps you to reduce the risk, because you end up with more shares at the cheaper prices, and fewer shares at the more expensive prices, so even a small rise in the value of the stock helps increase return.

To flourish, long-term investing takes diligent planning and research. With limited time and knowledge of how investments work, a financial planner can take the burden of research off you. They are trained in investing and start by looking at your overall financial picture, then give you scenarios to help you confidently decide the best course of action. A good financial planner won’t simply tell you should or should not invest. They will listen and analyze your financial history, then guide you through making investment strategies to help you and your family prosper.

Our clients often say they wish they would have started their financial plan sooner. So, what are you waiting for? We offer a complimentary discovery call to any doctor who has investing questions. If you are ready to start the discussion, schedule a call with or financial specialist Shane Tenny!

*Continuous or periodic investment plans neither assure a profit nor protect against loss in declining markets. Because Dollar Cost Averaging involves continuous investing regardless of fluctuating price levels, you should carefully consider your financial ability to continue investing through periods of fluctuating prices.

There are fees and charges associated with investing in mutual funds. Mutual funds are subject to market risk, including the potential loss of principal.

CRN202209-270649

Shane Tenny, CFP®, is the Managing Partner of Spaugh Dameron Tenny and a nationally recognized financial advisor. Since 2000, he has combined extensive financial knowledge with a passion for behavioral finance—helping clients make informed decisions based on both data and mindset. Shane often contributes to industry publications, appears as a guest on podcasts, and has been a leader in the financial planning field for years. He is known for making complex topics clear and practical for busy, high-income professionals seeking personalized advice they can trust.

Many investors consider rental real estate and diversified portfolios as potential sources of passive income, but each comes with its own ...

Read More →Have you ever felt like you're falling behind or wondered if you’re on the right track for a stress-free retirement?

Read More →How Public Company Executives Can Think Differently About Investing If you’re an executive at a publicly traded company, your daily routine is ...

Read More →