Transition planning involves preparing for the financial and lifestyle changes that take place as you transition from training to practice. This is a time period when a lot of new decisions need to be made.

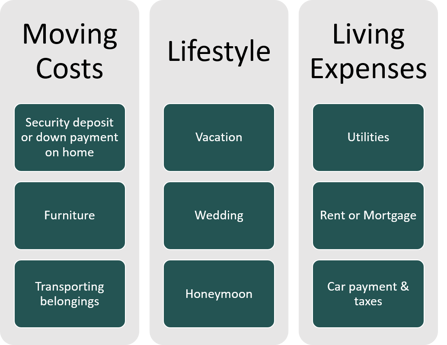

The transition period is also typically a time when many physicians get married, move, or take vacations. Your buffer of savings may be needed to cover some or all of the following expenses:

It's important to note that moving costs are sometimes reimbursed, but typically you must initially pay out-of-pocket. The list of expenses above does not include miscellaneous daily costs of living while in transition.

Will there be a lapse in your health insurance as you transition? Typically, yes. What will you do to insure yourself and your family during that time? When will your new health insurance start?

Should you consider your employer’s COBRA options or an alternative solution? The last thing you want to worry about is your expenses should you become ill or injured during this transitionary time.

NOTE: It is very important to know COBRA start and end dates and confirm them, as well as the start date for your new employer’s health insurance.

What will you do with your retirement plan from your previous employer? Will you keep the funds in the same account they were previously in? Will you roll them over into a new account with your new employer’s contributions?

This is a very busy time. How will you prepare to relocate, get credentialed, and acclimate to your new surroundings? Will you be buying or renting a home? You will definitely want to have your living arrangements taken care of, in addition to your working arrangements.

All of these considerations require cash. Without planning for your transition period, the default could be to run up credit card debt or take out a loan. Sometimes, this is the only option.

If, for example, this is the first time you’ve considered saving for your transition period and it’s coming up in a month, it’s probably not possible for you to save up enough cash to last through that time without using your credit card.

If this is the case, you want to make sure part of your new budget accounts for paying off your credit card debt and establishing an emergency fund as soon as possible. Speaking with a financial planner can help you determine what you need to allocate toward your credit card balances and paying down your loans.

Continue to the next part of this two-part transition planning blog to find out how much cash we suggest to save for your transition period.

Cover/Thumbnail photo from Op-Med | CRN202006-232311

John Dameron has been a financial planner and partner with Spaugh Dameron Tenny since 2002. With the help of the SDT team, John created a lecture series called Physicians Financial Focus, authored a book entitled The Residents and Fellows Financial Survival Guide, and has coached hundreds of physicians from residency/fellowship into practice. His expertise has also been featured on KevinMD.

Finance has a reputation for being complicated and confusing. And like many industries, finance has its own vocabulary, acronyms, strategies, and ...

Read More →I have a friend who works at Novo Nordisk, a pharmaceutical company, which you may not have heard of, but undoubtedly, you've heard of what they make ...

Read More →If you've never heard the term "financial infidelity," it doesn't mean you don't know what it is. In fact, according to a recent CreditCards.com ...

Read More →